- LOGIN

- MemberShip

- 2026-01-02 06:33:28

- Introduction of new PNH drugs…expanding competition landscape

- by Son, Hyung Min | translator | 2025-12-30 07:00:59

The competition landscape for Paroxysmal Nocturnal Hemoglobinuria (PNH) treatment market in South Korea has intensified with the introduction of a new C5 complement inhibitor.

The market, which was dominated by AstraZeneca's C5 inhibitors 'Soliris (eculizumab)·Ultomiris (ravulizumab)', is expected to see full-scale competition from new mechanism treatments, including C3·Factor B·Factor D inhibitors. Industry observers anticipate that the key criteria for selecting PNH treatments will shift from mechanism alone to factors such as administration convenience, including dosing intervals and formulations.

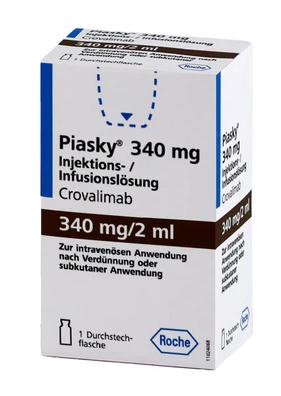

According to industry sources on December 27, the Ministry of Food and Drug Safety (MFDS) approved Roche's PNH treatment, 'Piasky (crovalimab)', on December 24. Piasky is a C5 complement inhibitor developed by Roche. This drug works by administering a low dose subcutaneously (SC) every 4 weeks, which then recirculates in the blood to inhibit complement activity continuously.

Piasky obtained U.S. FDA approval in June last year and was commercialized in Europe in August of the same year. In South Korea, it was designated as an orphan drug in February of last year.

The basis of approval is the results of the Phase 3 COMMODORE 2 study. COMMODORE 2 was a randomized, open-label, active-controlled non-inferiority trial comparing Piasky directly with the current standard of care, AstraZeneca's Soliris, in PNH patients aged 13 and older weighing at least 40 kg.

The primary endpoints of the trial were transfusion avoidance and hemolysis control rates. The secondary endpoints included breakthrough hemolysis, hemoglobin stabilization, changes in fatigue, and safety.

In the studies, the hemolysis control rate from week 5 to week 25 was 79.3% in the Piasky group and 79.0% in the Soliris group, successfully meeting the criteria for non-inferiority.

The proportion of patients who avoided red blood cell transfusions from baseline to week 25 was also similar, at 65.7% and 68.1%, respectively. The incidence of breakthrough hemolysis tended to be lower in the Piasky group (10.4%) than in the control group (14.5%), and there was no significant difference between the two groups in the proportion of patients maintaining stable hemoglobin levels.

In terms of safety, the Piasky group had an approximately 6% incidence of serious adverse events, with epistaxis, pneumonia, and infusion-related reactions as the primary reports. The overall adverse event profile was similar to that of existing C5 inhibitors.

C3 and Factor B...Competition over 'Mechanism + Convenience' begins in full-scale

Following the domestic approval of Piasky, the PNH treatment market is expected to shift from the existing C5-inhibitor-dominated structure into a phase of competitive diversification in mechanisms.

PNH is a rare disease caused by acquired genetic mutations. While multiple mutations in hematopoietic stem cells can lead to blood cancers, PNH occurs when a mutation develops in the X-linked PIGA gene.

PNH is reportedly a disease without a fundamental cure. However, with scientific advances, the development of treatments that inhibit complement activation is changing the therapeutic approach. The complement system is a core element of innate immunity, a robust defense that directly attacks and destroys pathogens. This system consists of various pathways, such as C3 and C5, and ultimately forms the membrane attack complex (MAC) to destroy red blood cells.

Until now, treatments inhibiting C5, located at the terminal pathway of the complement system, have been primarily used. The treatment environment improved with the introduction of Soliris, an injectable administered every two weeks, followed by Ultomiris, which can be administered every eight weeks. Many patients still manage the disease based on these treatments.

Recently, the competitive axis has widened with the addition of Handok's C3 inhibitor 'Empaveli (pegcetacoplan)', Novartis's Factor B inhibitor 'Fabhalta (iptacopan)', and AstraZeneca's Factor D inhibitor 'Voydeya (danicopan)'. Each drug targets a different stage in the complement system. They have been designed to employ strategies to address unmet needs, such as extravascular hemolysis (EVH), may persist even after C5 inhibition.

Analysts suggest that the future market landscape will likely be driven more by administration convenience than by differences in efficacy.

The dosing structure of Voydeya is complex requiring co-administration with a C5 inhibitor. However, it offers the advantage of potentially easier compliance management.

For Fabhalta, its oral formulation is a strength, offering greater dosing convenience than injectables. This treatment is particularly effective for treating anemia and EVH.

Empaveli poses burden of twice-weekly subcutaneous injections, but it remains an option for patients who can expect clinical effects from direct inhibition at the C3 stage. Experts evaluate it as a sufficiently effective option for patients who do not have a strong aversion to injections.

Empaveli was developed by the U.S. company Apellis Pharmaceuticals, while Swedish Orphan Biovitrum (Sobi) holds the rights outside the United States. Handok signed a strategic partnership agreement with Sobi in 2023 to introduce Empaveli into the Korean market.

-

- 0

댓글 운영방식은

댓글은 실명게재와 익명게재 방식이 있으며, 실명은 이름과 아이디가 노출됩니다. 익명은 필명으로 등록 가능하며, 대댓글은 익명으로 등록 가능합니다.

댓글 노출방식은

댓글 명예자문위원(팜-코니언-필기모양 아이콘)으로 위촉된 데일리팜 회원의 댓글은 ‘게시판형 보기’와 ’펼쳐보기형’ 리스트에서 항상 최상단에 노출됩니다. 새로운 댓글을 올리는 일반회원은 ‘게시판형’과 ‘펼쳐보기형’ 모두 팜코니언 회원이 쓴 댓글의 하단에 실시간 노출됩니다.

댓글의 삭제 기준은

다음의 경우 사전 통보없이 삭제하고 아이디 이용정지 또는 영구 가입제한이 될 수도 있습니다.

-

저작권·인격권 등 타인의 권리를 침해하는 경우

상용 프로그램의 등록과 게재, 배포를 안내하는 게시물

타인 또는 제3자의 저작권 및 기타 권리를 침해한 내용을 담은 게시물

-

근거 없는 비방·명예를 훼손하는 게시물

특정 이용자 및 개인에 대한 인신 공격적인 내용의 글 및 직접적인 욕설이 사용된 경우

특정 지역 및 종교간의 감정대립을 조장하는 내용

사실 확인이 안된 소문을 유포 시키는 경우

욕설과 비어, 속어를 담은 내용

정당법 및 공직선거법, 관계 법령에 저촉되는 경우(선관위 요청 시 즉시 삭제)

특정 지역이나 단체를 비하하는 경우

특정인의 명예를 훼손하여 해당인이 삭제를 요청하는 경우

특정인의 개인정보(주민등록번호, 전화, 상세주소 등)를 무단으로 게시하는 경우

타인의 ID 혹은 닉네임을 도용하는 경우

-

게시판 특성상 제한되는 내용

서비스 주제와 맞지 않는 내용의 글을 게재한 경우

동일 내용의 연속 게재 및 여러 기사에 중복 게재한 경우

부분적으로 변경하여 반복 게재하는 경우도 포함

제목과 관련 없는 내용의 게시물, 제목과 본문이 무관한 경우

돈벌기 및 직·간접 상업적 목적의 내용이 포함된 게시물

게시물 읽기 유도 등을 위해 내용과 무관한 제목을 사용한 경우

-

수사기관 등의 공식적인 요청이 있는 경우

-

기타사항

각 서비스의 필요성에 따라 미리 공지한 경우

기타 법률에 저촉되는 정보 게재를 목적으로 할 경우

기타 원만한 운영을 위해 운영자가 필요하다고 판단되는 내용

-

사실 관계 확인 후 삭제

저작권자로부터 허락받지 않은 내용을 무단 게재, 복제, 배포하는 경우

타인의 초상권을 침해하거나 개인정보를 유출하는 경우

당사에 제공한 이용자의 정보가 허위인 경우 (타인의 ID, 비밀번호 도용 등)

※이상의 내용중 일부 사항에 적용될 경우 이용약관 및 관련 법률에 의해 제재를 받으실 수도 있으며, 민·형사상 처벌을 받을 수도 있습니다.

※위에 명시되지 않은 내용이더라도 불법적인 내용으로 판단되거나 데일리팜 서비스에 바람직하지 않다고 판단되는 경우는 선 조치 이후 본 관리 기준을 수정 공시하겠습니다.

※기타 문의 사항은 데일리팜 운영자에게 연락주십시오. 메일 주소는 dailypharm@dailypharm.com입니다.