- LOGIN

- MemberShip

- 2025-12-22 13:31:21

- Company

- ‘The new ATTR-CM treatment can improve patient survival’

- by Whang, byung-woo Nov 27, 2024 05:50am

- With the possibility for reimbursement coverage for the ultra-rare disease, transthyretin amyloid cardiomyopathy (ATTR-CM) rising, excitement is also rising in the clinical site. Due to the short life expectancy of ATTR-CM - 2-3.5 years after diagnosis – and no clear treatment option available, the benefits of a new treatment option are expected to be significant. As an extremely rare disease with a small number of patients, challenges still remain in identifying and diagnosing patients early. Dailypharm met with Dr. Junho Hyun, Professor of Cardiology at Asan Medical Center in Seoul, to discuss Korea’s treatment environment for ATTR-CM and the changes made since the reimbursement of its treatment option. Junho Hyun, Professor of Cardiology, Seoul Asan Medical Center ATTR-CM is a rare, progressive disease where a protein called transthyretin (TTR) misfolds and forms harmful amyloid deposits in the heart. Although it is caused by genetic issues, it can also occur with aging. In particular, ATTR-CM is a rare disease that is most commonly found in patients over the age of 65, so experts believe its patient population could grow as Korea enters an aged society. "The exact prevalence of ATTR-CM patients in Korea is unknown, but what is known is that it is expressed in a different form in Korea than in other countries," said Professor Hyun. "In the United States, the number of affected patients was identified through the patient registration system and the introduction of its treatment was also fairly quick. Korea needs to improve the overall treatment environment for ATTR-CM patients, including its management, diagnosis, and treatment," said Dr. Lee. "The most common cause of cardiac amyloidosis is AL amyloidosis, followed by ATTR amyloidosis, so we test for these 2 possibilities at the time of initial diagnosis," he said. "We also use nuclear scintigraph to diagnose ATTR-CM, and then genetic testing to differentiate between the hereditary and wild-type. In some cases where nuclear scintigraphs are not available, we test the heart tissue." According to Professor Hyun, the diagnosis of ATTR-CM patients in the United States is slowly increasing. He believes that this is due to increased awareness, which, like other diseases, has led to the development of treatments. In the past, patients with hereditary ATTR-CM often died suddenly without knowing the cause of their disease due to low awareness, but early identification of patients has led to higher diagnosis rates the patients’ families can also be diagnosed and treated. From a treatment standpoint, prior to the approval of Vyndamax (tafamidis) in 2020, the doctors had lacked options - using diuretics to relieve symptoms or carrying out heart and liver transplants. However, despite the emergence of a treatment, its high price remains a hurdle. Recently, Vyndamax’s reimbursement agenda passed the review of the Drug Reimbursement Evaluation Committee of the Health Insurance Review and Assessment Service 4 years after its approval, leaving only drug price negotiations with the National Health Insurance Service. "With a median survival of only 2-3 years, patients with ATTR-CM despair due to the fact that treatment options are available but unaffordable. It's very unfortunate that there is a cure, but it's not covered by insurance, which limits treatment," added Hyun. While he understands the limitations that exist due to government budgets, Hyun believes that reducing mortality through early treatment of ATTR-CM patients is more cost-effective. "In Korea, the deterioration of ATTR-CM symptoms slowed down or even improved in some cases in patients who used the drug through patient support programs. However, it is less effective if the timing of treatment is delayed due to delayed access and the disease progresses, so it is necessary to set reimbursement standards so that the drug can be used from an early stage in addition to patients with severe symptoms." "ATTR-CM is like cancer in that it has a very short median overall survival, so it is very unfortunate that its treatment options are being restricted because it is a rare disease with a small number of patients," said Professor Hyun. "The medical gap that exists due to the high treatment cost is a social problem, which requires serious government consideration.”

- Company

- Active development of new drugs for myasthenia gravis

- by Son, Hyung Min Nov 27, 2024 05:50am

- Competition in the pharmaceutical market is heating up to secure myasthenia gravis indication. UCB's new drug was approved in South Korea, and Janssen finished the phase 3 trial, aiming to acquire regulatory approvals worldwide. In South Korea, Handok seeks to enter the market with its acquired new drug. HanAll Biopharma is conducting a Phase 3 trial and investigating the potential of commercialization. According to industry sources on November 27, UCB's 'Zilbrysq' was approved in South Korea on November 21. Zilbrysq can be used as an add-on to standard therapies, such as cholinesterase inhibitors, steroids, and immune checkpoint inhibitors. This therapy is a complement C5 inhibitor and works by inhibiting the complement-mediated damage to the neuromuscular junction (NMJ). Product photo of UCBDue to this approval, Zilbrysq became the first treatment that can be self-administered, unlike other domestically approved treatments for adult myasthenia gravis. 'Ultomiris,' a complement C5 inhibitor used to treat existing myasthenia gravis, is an intravenous injectable that requires administration at hospital visits every 8 weeks. Generalized myasthenia gravis (gMG) is a chronic autoimmune rare disease in which nerves fail to transmit signals to muscles, leading to skeletal muscle weakness. This disease induces fluctuating weakness of systemic muscles, affecting daily activities such as standing, swallowing, and breathing. Zilbrysq's approval is based on the Phase 3 'RAISE' study. The study evaluated the efficacy and safety of Zilbrysq in 174 adult patients with anti-acetylcholine receptor (AchR) positive gMG. The primary endpoint was the 'Myasthenia Gravis-Activities of Daily Living (MG-ADL)' for gMG. Typically, an MG-ADL score of 2 or higher or a Quantitative Myasthenia Gravis (QMG) score of 3 or higher indicates clinically significant improvement. The clinical results showed that the Zilbrysq group showed a clinically significant reduction by a total score of 4.39 from baseline at 12 weeks compared to the score of 2.30 of the placebo group. In addition to working on Zilbrysq, UCB is preparing to expand approvals of 'Rystiggo,' UCB's additional treatment for myasthenia gravis, in countries. Rystiggo obtained the U.S. Food and Drug Administration (FDA) approval in June 2023 and was also approved in Europe in January of this year. Janssen has recently completed the Phase 3 trial of 'nipocalimab,' a new drug candidate for myasthenia gravis and the company is preparing to obtain approval. Janssen applied to obtain approvals from the FDA in August and the European Medicines Agency (EMA) in September. Nipocalimab works by a novel mechanism that blocks the Fc receptor (FcRn), a protective immunoglobulin G (IgG) receptor. This mechanism reduces IgG antibodies that cause the disease and inhibits their recycling process. Nipocalimab binds to FcRn to prevent the degradation of IgG antibodies. The Phase 3 Vivacity-MG3 study demonstrated the efficacy of nipocalimab in combination with standard therapy compared to the placebo. The clinical study confirmed a statistically significant result, with nipocalimab recording an MG-ADL score of 4.70. Also, nipocalimab improved the myasthenia gravis patients' muscular strength and function compared to the placebo. Handok·HanAll aim to commercialize their treatments with a similar mechanism to nipocalimab In South Korea, Handok is preparing for the new drug approval for the treatment of myasthenia gravis. In August. Handok signed an agreement with argenx, the Belgium-based developer of Vyvgart. Handok is now responsible for domestic approval registration, applying for reimbursement, and exclusive distribution. Like nipocalimab, Vyvgarth is a new drug targeting the FcRn. It has been approved in several countries, including the United States, Europe, the United Kingdom, Israel, and China, for treating adult patients with generalized myasthenia gravis. The clinical efficacy of Vyvgarth was demonstrated in the Phase 3 clinical trial named ADAPT. It was shown that Vyvgarth recorded a 68% responder rate based on the MG-ADL scale, significantly higher than the 30% of the placebo. Additionally, Vyvgarth demonstrated an improved score compared to the placebo group on the QMG scale. HanAll Biopharma is also developing an FcRn antibody treatment candidate, batoclimab (HL161), as a subcutaneous injectable. In December 2023, HanAll Biopharma's Chinese partner, Harbour BioMed, secured Phase 3 clinical trial results and submitted an approval application to Chinese regulatory authorities. Harbour BioMed said that batoclimab improved symptoms in myasthenia gravis patients based on MG-ADL and QMG scales. HanAll Biopharma is conducting a phase 3 trial for batoclimab in the United States. HanAll Biopharma's U.S. partnering company Immunovant finished registering patients for the Phase 3 clinical for myasthenia gravis. Immunovant plans to present top-line results of the phase 3 clinical trial in the first half of 2025. HanAll Biopharma and Immunovant plan to investigate the potential of batoclimab for various autoimmune disease indications, including thyroid eye disease and chronic inflammatory demyelinating polyneuropathy. In addition to developing batoclimab, both companies will develop new drugs for additional myasthenia gravis indication. HanAll Biopharma and Immunovant are conducting a phase 1 trial of IMVT-1402, a new FcRn antibody drug candidate product. Unlike conventional FcRn antibody treatments, IMVT-1402 is not known to affect the LDL-cholesterol level. In the Phase 1 clinical trial, subcutaneous injection of IMVT-1402 and placebo are administered to randomized healthy adults. Each patient group receives a single-dose or multiple doses with a dose-escalation.

- Company

- 4 of 5 listed pharma companies expand investments

- by Chon, Seung-Hyun Nov 26, 2024 05:54am

- Pharmaceutical companies have significantly expanded their research and development (R&D) investments to discover their next item. Five out of five major pharma and biotech companies increased their R&D spending this year compared to the previous year. The top pharmaceutical companies in terms of sales have been investing heavily in R&D to develop new drugs. Yuhan Crop, Celltrion, and Dong-A ST showed a significant increase in R&D expenditures. According to the Financial Supervisory Service on the 25th, the cumulative R&D investments of 20 major pharmaceutical and biotech companies totaled to KRW 1.867 trillion in Q3, up 14.5% from the KRW 1.6387 trillion in the same period last year. The data was compiled from 20 listed pharmaceutical companies with the highest sales of main drug products. Ildong Pharmaceutical, which spun off its R&D subsidiary last year, was not included in the survey. Sixteen of the 20 major pharmaceutical companies increased their R&D investment this year compared to the same period last year. Celltrion, Samsung Biologics, Yuhan Corp, Daewoong Pharmaceutical, Hanmi Pharmaceutical, SK Biopharmaceuticals, Chong Kun Dang, Dong-A ST, HK Inno.N, JW Pharmaceutical, Boryung Pharmaceutical, Daewon Pharm, Huons, Dongkook Pharmaceutical, Dongwha Pharmaceutical, and Celltrion Pharmaceutical showed an increase in R&D expenditures through the third quarter compared to last year. Yuhan Corp showed the largest increase in R&D expenditure this year. The company invested KRW 201.1 billion in R&D through the third quarter, up 48.5% from KRW 135.4 billion it had invested in the same period last year. The increase was largely due to the reallocation of technology fees it accrued from its anti-cancer drug Leclaza. In August, the U.S. Food and Drug Administration (FDA) approved Leclaza in combination with Rybrevant for the first-line treatment of adult patients with locally advanced or metastatic non-small cell lung cancer (NSCLC) with a confirmed epidermal growth factor receptor (EGFR) exon 19 deletion or exon 21 L858R substitution mutation. Yuhan Corp received a USD 60 million technology fee from Janssen Biotech for the FDA approval of Leclaza. Of the total Leclaza royalties received, 40% was paid to the original developer, Oscotec. In 2016, the company acquired the preclinical development rights to Leclaza from Oscotec and its subsidiary Genosco. The technology fees redistributed to Oscotec were recognized as R&D expenses. This significantly increased the company’s R&D expenses as Yuhan paid more than KRW 30 billion to Oscotec out of the royalties it had received for Leclaza. In the first half of the year, Yuhan’s R&D expenses were high due to the introduction of promising technologies from bioventures. In March, the company paid KRW 6 billion to acquire the technology of SOS1-inhibiting anti-cancer drug candidates from Cyrus Therapeutics and Kanap Therapeutics. In the second quarter, the bank paid KRW 3 billion in technology fees to a biotech company, J Ints Bio. Celltrion reported cumulative R&D expenses of KRW 312.8 billion in the third quarter, up 34.0% YoY. Celltrion has received approval for 2 biosimilars in Europe so far this year. In May, the company received marketing authorization from the European Commission for its first biosimilar of Xolair, Omlyclo. Xolair is an antibody-based biological drug used to treat allergic asthma, chronic rhinosinusitis with nasal polyps, and chronic idiopathic urticaria. In August, the company received approval for SteQeyma, a biosimilar to the autoimmune disease treatment Stelara, received European marketing authorization. Stella Stelara is a Janssen-developed autoimmune disease treatment for plaque psoriasis, psoriatic arthritis, Crohn's disease, and ulcerative colitis. Celltrion has acquired 8 and 6 approvals in Europe and the U.S., respectively. Celltrion is developing follow-on biosimilars for Keytruda, Prolia, Actemra, Cosentyx, and Ocrevus. Dong-A S&T's R&D expenditure through the third quarter was KRW 103 billion, up 25.5% YoY. Its clinical expenses for new drug development increased significantly. DA-4505, an immuno-oncology drug, was approved for Phase I/IIa clinical trials in Korea in November last year. DA-4505 showed improved tumor suppression through preclinical studies compared to AhR antagonists being developed by global pharmaceutical companies. A Phase III clinical trial for DA-8010, a treatment for overactive bladder, was completed in Korea in May. However, DA-8010 did not show a statistically significant difference. In October, Dong-A ST’s Stelara biosimilar Imuldosa received final approval from the FDA, marking the company's entry into the U.S. market. The company passed the U.S. market gateway 11 years after starting the development of Imuldosa in 2013. SK Biopharmaceuticals, Boryung, Samsung Biologics, Daewoong Pharmaceuticals, Hanmi Pharmaceuticals, and HK Inno.N have expanded their R&D expenditures by more than 10% YoY through the third quarter of this year. The increase in R&D expenditures was larger among pharmaceutical companies with larger sales. Samsung Biologics, Celltrion, Yuhan Corp, GC Biopharma, Chong Kun Dang, Hanmi Pharmaceutical, Daewoong Pharmaceutical, Boryung Pharmaceutical, and HK Inno.N have invested KRW 1.49 trillion in R&D this year, up 16.8% from the previous year. Of the top 10 companies by revenue, nine, except for GC Biopharma, increased their investment from last year. It is analyzed that large pharmaceutical companies, which have accumulated experience in developing new drugs and are actively seeking to expand globally, have been actively investing in R&D to discover new items. SK Biopharmaceuticals had the highest R&D investment-to-sales ratio, at 30.7%. Dong-A ST and Daewoong Pharmaceutical followed with 19.9% and 18.3%, respectively, while Hanmi Pharmaceutical, Yuhan Corp, Celltrion, and JW Pharmaceutical also invested more than 10% of their sales in R&D.

- Company

- Will Imfinzi and Imjudo be reimbursed in Korea?

- by Eo, Yun-Ho Nov 26, 2024 05:54am

- Whether the immuno-oncology drug combination of Imfinzi and Imjudo will gain a place as a treatment option for liver cancer in Korea is gaining attention. AstraZeneca Korea's combination therapy of PD-L1 inhibitor Imfinzi (durvalumab) and CTLA-4 inhibitor Imjudo (tremelimumab) recently passed the Health Insurance Review and Assessment Service’s Cancer Disease Deliberation Committee review and is headed towards a Drug Reimbursement Evaluation Committee review. Given that the application was submitted in June, this is a relatively fast track reaching coverage in Korea, which is why the industry’s eyes are on how quickly the combination therapy will be approved for reimbursement. The immunotherapy combo will first target liver cancer, as the combination was approved as a first-line treatment for adult patients with advanced or unresectable hepatocellular carcinoma (liver cancer). More specifically, the approved STRIDE regimen (Single Tremelimumab Regular Interval Durvalumab) includes an initial single dose of Imjudo 300mg added to Imfinzi 1500mg, followed by Imfinzi every 4 weeks. At the recent European Society for Medical Oncology (ESMO) Congress 2024, the 5-year overall survival data from the Phase III HIMALAYA trial that demonstrated the efficacy of the Imfinzi and Imjudo combination in hepatocellular carcinoma was presented. In the HIMALAYA trial, patients with inoperable HCC were treated with STRIDE (single dose of Imjudo followed by Imfinzi maintenance therapy), Imfinzi monotherapy, and sorafenib monotherapy. When comparing the results of the Imfinzi and Imjudo combination with sorafenib combination therapy in patients with unresectable HCC, patients who received the STRIDE regimen had a 5-year overall survival (OS) rate of 19.6%, compared with the 9.4% for patients who received sorafenib. The median overall survival was 16.43 months and 13.77 months, respectively, showing a 24% lower risk of death in the Imfinzi-Imjudo combination arm. “ The Imfinzi-Imjudo combination therapy has significant advantages in that it has a much lower risk of bleeding than conventional therapies and does not worsen liver function," said Hong Jae Chon, Professor of Hemato-Oncology at CHA Bundang Medical Center. “In particular, the combination shows potential for longer survival than existing therapies."

- Company

- ‘Oral drugs can address the unmet PNH treatment needs’

- by Son, Hyung Min Nov 26, 2024 05:54am

- Dr. Jun Ho Jang, Professor of Medicine, Department of Hematology-Oncology, Samsung Medical Center The paroxysmal nocturnal hemoglobinuria (PNH) market, which has been dominated by AstraZeneca's Soliris and Ultomiris, has seen the introduction of the oral drug Fabhalta. Experts believe that Fabhalta’s use will increase in the future as it has been shown to reduce anemia and blood transfusions compared to existing treatments. On the 25th, Novartis Korea held a press conference for specialized journalists in Samseong-dong, Seoul, to celebrate the approval of Fabhalta in Korea. Fabhalta was approved in August as the first oral treatment for PNH. PNH is a rare and life-threatening disease caused by the destruction of red blood cells in the blood vessels, leading to symptoms of bloody urine and complications such as acute kidney failure. The disease is estimated to affect approximately 1.5 people per million worldwide. Its incidence is higher in East Asian countries such as Korea, China, and Japan than in Western countries. The number of PNH patients in Korea is expected to have approximately doubled from 260 in 2010 to 504 in 2023, with the number still on the rise. Fabhalta is a factor B inhibitor that acts proximally in the immune system's alternative complement pathway and has a comprehensive mechanism of action that controls red blood cell destruction. Previously, PNH has been treated with C5 inhibitor drugs, including Soliris and Ultomiris. However, while C5 inhibitors reduce the risk of thromboembolism by controlling intravascular hemolysis, they may not completely inhibit extravascular hemolysis. Up to 50% of patients on C5 inhibitors experience extravascular hemolysis, which is a major contributor to the development of persistent anemia. In addition, approximately 80% of PNH patients treated with C5 inhibitors have had an incomplete response to treatment, to the extent that they required transfusions or experienced anemia. Fabhalta has been shown to be effective in patients both on and off C5 inhibitors. The drug’s efficacy was confirmed through the Phase III APPLY-PNH trial in patients with residual anemia despite prior anti-C5 treatment who switched to Fabhalta and the Phase III APPOINT-PNH study in complement inhibitor-naïve patients. Trial results showed that 82.3% of anti-C5-experienced Fabhalta patients, 0% of anti-C5-treated patients, and 77.5% of complement inhibitor-naïve patients showed a sustained increase of hemoglobin levels of 2 g/dLa or higher from baseline in the absence of transfusions. The patients’ hemoglobin level was maintained in the 48-week extension study. The study showed that patients who continued to take C5 inhibitors had hemoglobin levels similar to those of the initial switch group when they switched to Fabhalta at Week 24, and the fatigue score returned to those of healthy individuals in the Fabhalta arm. In terms of safety, there were no treatment-related adverse events with Fabhalta that required treatment discontinuation. The incidence of clinical breakthrough hemolysis was significantly lower with Fabhalta compared to C5 inhibitors, and headache, nausea, and diarrhea occurred but were resolved within 1 week. An advantage of Fabhalta is its formulation. As an oral formulation, the drug offers better dosing convenience over existing intravenous formulations like Soliris and Ultomiris. Currently, Soliris (a 4-hour infusion once every 2 weeks) and Ultomiris (a 5.5-hour visit once every 8 weeks) require an in-person visit for their administration in the hospital. The introduction of C5 inhibitors has significantly improved the treatment of PNH, but there is an unmet need amongst patients who are unable to benefit from the use of C5 inhibitors or experience side effects,” said Dr. Jun Ho Jang, Professor of Medicine, Department of Hematology-Oncology, Samsung Medical Center. ”Up to 82% of patients do not achieve normal hemoglobin levels with C5 inhibitors, which can lead to anemia and blood clots. “ “Fabhalta targets both intravascular and extravascular hemolysis. Its strength lies in its ability to normalize hemoglobin and LDH levels,” added Jang. “In addition, switching from existing therapies to Fabhalta can improve patients’ quality of life by reducing fatigue, and can help patients overcome transfusion dependency.”

- Company

- "Pharmaceutical companies using CSOs must renew contracts

- by Kim, Jin-Gu Nov 26, 2024 05:53am

- Based on the Contract Sales Organization (CSO) reporting system implemented last month, pharmaceutical companies must be aware of potential legal risks. Pharmaceutical companies using CSOs must sign contracts with companies that have completed registration and renew existing contracts to align with the timeline following reporting. The Korea Pharmaceutical and Bio-Pharma Manufacturers Association (KPBMA) hosted the On November 22, the Korea Pharmaceutical and Bio-Pharma Manufacturers Association (KPBMA) hosted the 'Ethical Management Workshop for the Second Half of 2024' at the Mondrian Seoul Itaewon. During the workshop, Attorney Park Jong-cheol from the law firm Hwawoo advised as such. Over 300 compliance officers (CP) from the pharmaceutical industry, in-person and online, have participated. Park presented strategies for minimizing legal risks for pharmaceutical companies using CSOs. According to him, these companies face various legal risks, including violations related to illegal rebates, labor laws, fair trade laws, and pharmaceutical laws. To minimize risks, Park emphasized the necessity of continuous management and oversight of CSOs and maintaining detailed records as evidence. Park also advised that promotional activities conducted by in-house sales teams and those belonging to CSOs should not overlap. To minimize risks, He said, "Companies must select larger, established firms capable of independently fulfilling contractual obligations." Park gave examples of practices that could constitute violations of the Fair Trade Act. He explained that these include cases where a CSO provides excessively high or low compensation to healthcare professionals, guarantees fixed margins, or continues transactions despite repeated unfair practices. Park also emphasized the importance of compliance with the CSO Reporting System, which has been effective since October 19. Under this system, pharmaceutical companies are permitted to contract only with CSO companies that have completed registration with local governments. Any existing contracts must be renewed following the registration date to ensure compliance. Contracts must include the following details: ▲The name of the pharmaceutical promotion agent ▲The name of the representative, the location of the business office, registration number, and business registration number ▲Details of the promotional activities entrusted, including the names of the delegated pharmaceutical products and the commission rates for each item ▲Duration of the contract ▲Obligations and compliance requirements for the entrusted party, including training provisions. The mandatory retention period for these contracts is five years, and they must be submitted to the MOHW upon request. Park advised, "If an existing contracted company fails to register, the termination of the contract should be considered." He added, "During subcontracting, oversight may become less stringent. It is advisable to diversify CSO transactions and standardize transaction terms to better align with industry standards." "Increasingly rigorous tax audits on pharmaceutical companies…must prepare by conducting diagnostics assessment" Suseok Ryu, an accountant at KPMG Samjong Accounting, explained ways to respond to the high-intensity investigation of the pharmaceutical industry by the National Tax Service. Ryu said the pharmaceutical and biotech industries have faced increasingly rigorous tax audits. These audits are characterized by extended or suspended timelines and comprehensive requests for access to companies’ IT systems. Both planned and unplanned investigations have become more frequent, while the intensity of regular audits has also increased. The documents requested during these audits cover a wide range, including internal company policies on sales incentives, discounts, and employee welfare expenses, domestic and international bank account details showing cash and cash-equivalent assets, expenditure reports and corporate card usage records, gift card purchase records, distributor lists and related contracts, employee travel logs, and VAT non-deductible purchase details and data backups. In particular, the National Tax Service primarily focuses on illegal rebates, activities related to the Fair Competition Code, such as product briefings·academic conferences, costs incurred from returns or complaints by healthcare providers, sales discounts, sales incentives, and business travel expenses. "For pharmaceutical companies, tax audits heavily focus on identifying a history of rebates. Therefore, they must identify potential issues and prepare accordingly through tax diagnostics assessments," Ryu emphasized. "As tax investigators are authorized to review financial transactions without the taxpayer's consent, it is crucial to meticulously prepare supporting documentation to account for cash flow and ensure compliance." "For expenses related to academic conference funds, it is essential to secure documentation that can prove the advertising effects, such as booth operation photos and journal advertisement placement records." Ryu added, "Returns of unsellable pharmaceutical inventory should also be justified with detailed evidence, as they could otherwise be misconstrued as entertainment expenses." "Expenditure report will be disclosed at the end of year…must be thoroughly cross-checked for omission·errors" Han-Cheol Kang, an attorney at Kim & Chang's Corporate Compliance, introduced strategies to respond to potential disputes before releasing the first expenditure report at the end of the year. According to the revised Pharmaceutical Affairs Act, the government will disclose expenditure reports submitted by pharmaceutical companies and CSOs for the first time at the end of the year. Kang stressed the importance of accurate data entry. "Even in the U.S., which implemented its disclosure system after years of preparation, 31% of transaction records contained errors," Kang said. "The American Medical Association's findings attributed these issues to a lack of review opportunities and data inaccuracies." "Once expenditure reports are disclosed, they are difficult to amend and may lead to violations of the Pharmaceutical Affairs Act. Therefore, it is crucial to ensure no omissions or errors, such as incorrect attendee records," Kang stated. "It is also essential to cross-check the provided amounts and categories with supporting documentation to ensure accuracy." "Companies must prepare for potential disputes by securing evidence, establishing systems to verify facts, and implementing error-checking procedures," Kang emphasized. "The persistent practices of providing unjust economic benefits, practical challenges due to excessive regulations, and negative public opinion present significant risk factors both within and outside the industry," Jae-Kook Lee, Senior Vice President of KPBMA, said. "The pharmaceutical and biotech industries must not forget their responsibility to meet the era's·public's expectations. In collaboration with its 297 member companies, the KPBMA will continue to make every effort to promote ethical management practices."

- Company

- K-Bio to showcase at the ASH 2024

- by Son, Hyung Min Nov 25, 2024 05:54am

- Development accomplishments of the Korean pharmaceutical industry's blood cancer treatments will be showcased at an international conference. Hanmi Pharmaceutical, PharosiBio, LigaChem Biosciences, and Aptamer Sciences will present their promising clinical study results, and they are set to join the global stage. PharosiBio and Hanmi Pharmaceutical will present their clinical accomplishment of new drug candidates for acute myeloid leukemia (AML). Aptamer Sciences and LigaChem Biosciences will unveil the competitiveness of their antibody-drug candidate (ADC) platforms. Clinical results of AML will be showcased…new drug discovery platform competitiveness ↑ According to sources on November 23, the American Society of Hematology Annual Meeting and Exposition (ASH 2024) will take place from December 7 to 10 in San Diego, U.S. The American Society of Hematology, the world's largest blood cancer-related academic conference, commences its 66th meeting this year. Hanmi Pharmaceutical will showcase the clinical result of its innovative new drug candidate for AML, 'tuspetinib,' confirming the potential of the drug as a triple combination drug therapy at the ASH 2024. The results will be presented by Hanmi Pharmaceutical's U.S. partnering company, Aptose Biosciences. In 2021, Hanmi Pharmaceutical outlicensed tuspetinib to Canadian pharmaceutical company Aptose Biosciences. Tuspetinib is a new innovative drug targeting key kinases involved in myeloid malignancies. Tuspetinib works in a differentiated pattern. It has been developed as a once-daily administration. It received the fast-track designation pharmaceutical from the U.S. Food and Drug Administration (FDA) last year. Aptose Biosciences is currently investigating the potential of tuspetinib in combination with hypomethylating agents such as BCL2 inhibitor Venetoclax (product name: Venclexta) and azacitidine. Previously, Aptose Biosciences has reported that the combination therapy of tuspetinib and venetoclax in patients with relapsed or refractory AML demonstrated favorable safety profiles and positive drug responses, regardless of prior venetoclax treatment experience. In particular, with tuspetinib administration, no noticeable side effects or typical toxicity responses were observed in medications of the same class. It showed broad activity in all patients with AML who have genetic mutations. Aptose Biosciences will decide on the volume of the triple combination therapy and finish the pilot study by presenting it in the European Hematology Association (EHA) meeting next year. PharosiBio will showcase the Phase 1 trial results of its new drug candidate, 'PHI-101,' for AML. Along with the clinical Phase1b results conducted with PHI-101 160 mg monotherapy, this company is expected to unveil comprehensive clinical data after completing the recruitment of patients. PHI-101 is a targeted cancer agent being developed for treating patients with AML not responding to previous medications or who relapsed due to FLT3 mutation. This new drug candidate product targets the FLT3 gene mutation that occurs in 35% of all patients with AML, inhibiting the growth of cancer cells. In addition to the study of PHI-101 monotherapy, PharosiBio is also conducting clinical trials of combination therapy. The company confirmed the effects of triple combination drug therapy containing PHI-101, Venetoclax, and azacytidine. Venetoclax and azacytidine are used as a first-line treatment for adult patients with AML. In a xenograft animal model, PHI-101 showed a 95% tumor growth inhibition (TGI) when used in combination with Venetoclax. Additionally, when azacitidine was added to the PHI-101+Venetoclax combination therapy, the reported survival period was 53 days. This figure is longer than the 30 days of the control group. PharosiBio plans to investigate the potential of both monotherapy and combination therapy and aim to target all treatment phases. ASH 2023 photo (source=ASH). Development of ADC for blood cancer is actively conducted LigaChem Biosciences and Aptamer Sciences will report on competitiveness of their ADC platform. ADC is a novel anticancer drug that connects an antibody, which binds to specific antigens on the surface of cancer cells, with a cytotoxic drug linked by a linker. ADCs take advantage of antibodies' selectivity for their targets and the drug's cytotoxic activity to selectively target cancer cells, thereby increasing therapeutic efficacy while minimizing side effects. LigaChem Biosciences will unveil Phase 1 results of CS5001, an ROR1 targeting ADC candidate product under co-development with ABL. ROR1 is a protein that is strongly expressed during fetal development. The clinical trial analyzed the efficacy, pharmacokinetics (PK), and antitumor activity of CS5001 in patients with solid cancer and lymphoma. Based on the presented clinical results, in the first eight dose groups of CS5001, no dose-limiting toxicities (DLT) were observed. Superior safety and expected pharmacokinetics properties were reported, with the maximum tolerated dose (MTD) not being reached. Aptamer Sciences will showcase the study data of 'AST-202,' a new drug candidate product that was selected from utilizing ApDC (Aptamer-Drug Conjugates) in patients with blood cancer. ApDC is a next-generation ADC new drug development platform with its proprietary branched linker-payload technology. Aptamer Sciences has conducted a comparison study comparing ACD Adcetris and AST-202, which are used as conventional blood cancer treatment, and acquired a significant result in tumor-suppressing effects. In a lymphoma model, AST-202 demonstrated superior tumor-suppressing effects than Adcetris, and more than 80% of the AST-202-treated group survived.

- Company

- 'Altuviiio' for hemophilia A expected to be marketed in KOR

- by Eo, Yun-Ho Nov 25, 2024 05:53am

- 'Altuviiio,' a new once-weekly administered hemophilia A drug, is expected to be marketed in South Korea. According to industry sources, Sanofi-Aventis has recently submitted an application for approval of Altuviiio (efanesoctocog alfa). The Ministry of Food and Drug Safety (MFDS) granted this drug an Orphan Drug Designation (ODD) in May. Altuviiio recently received the 'Global Innovative products on Fast Track (GIFT)' designation. Altuviiio is the first hemophilia therapy to receive an orphan drug designation from the MFDS in South Korea other than a non-factor agent, which received the designation three years ago. Altuviiio is a first-in-class high sustained factor (HSF) therapy for hemophilia A. With once-weekly treatment, Altuviiio keeps hemophilia factor activity levels at over 40% and helps provide patients with a near to normal life. Following approval in the United States and Japan last year, it was approved in Europe this year. Benefits such as accelerated approval review and exemption from GMP facility inspection are granted when designated as an orphan drug. Additionally, drugs designated as a GIFT item undergo rolling review and receive an expert consulting through 1:1 support between the reviewer and the developer, allowing them to be marketed more quickly. Meanwhile, the efficacy of Altuviiio was demonstrated through the XTEND-1 global Phase 3 study. The study results demonstrated that the Altuviiio-administered group had a significant reduction of 77% in annualized bleeding rates (ABR) compared to a group with prior factor VIII prophylaxis. The average weekly factor VIII activity for the Altuviiio-administered group was over 40 IU/dL and they had shown levels of 15 IU/dL at 7 days. Also, Altuviiio demonstrated superior drug tolerance and antibody occurrence was not reported in the Altuviiio-administered group. The most common side effects of Altuviiio were headache, arthralgia, falling, and backache.

- Company

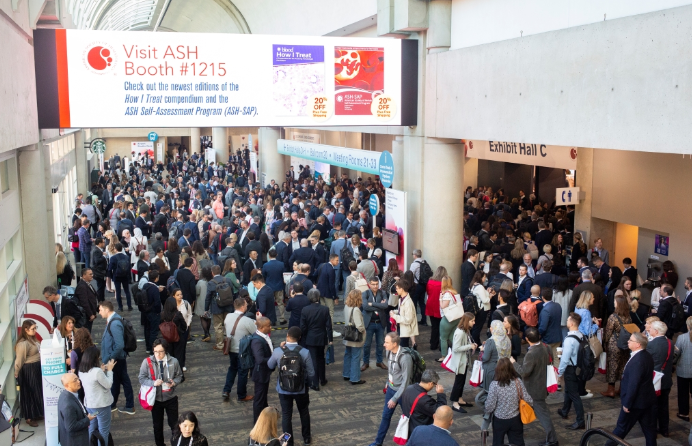

- "Korean pharma draws attention, open innovation will heat up

- by Son, Hyung Min Nov 22, 2024 05:56am

- The Ministry of Health and Welfare (MOHW) and the Korea Health Industry Development Institute (KHIDI) held the Global pharmaceutical companies continue to invest in research & development (R&D) to overcome patent expiration. Industry experts have said that open innovation between global pharmaceutical companies and Korean pharmaceutical companies will be fired up, enabling collaborations in various diseases. According to industry sources on November 21, the Ministry of Health and Welfare (MOHW) and the Korea Health Industry Development Institute (KHIDI) held the '2024 Global Open Innovation Week' on November 20 at El Tower, Seoul. Representatives from various global pharmaceutical companies, including BMS, Novo Nordisk, and Takeda, attended the event and presented about R&D approaches and collaboration opportunities for open innovation. Aiming new diseases…BMS develops ADC·radiopharmaceutical·neuroscience-drug BMS is one of the companies actively involved in open innovation and merger & acquisitions (M&A) deals. The company's patents for new drugs, coagulant agent 'Eliquis,' and multiple myeloma drug 'Revlimid,' have expired. Due to the introduction of generics, BMS is facing a reduction in sales. The immune checkpoint inhibitor, 'Opdivo,' which emerged as a global blockbuster drug, is also set to expire. In the past year and this year, BMS has invested in Karuna Therapeutics (US$14 billion), RayzeBio (US$4.1 billion), Mirati Therapeutics (US$4.8 billion), and SystImmune (US$8.4 billion), expanding its pipeline. BMS developed a new schizophrenia drug, Cobenfy, by acquiring Karuna Therapeutics. It also jumped into the radiopharmaceutical market by acquiring RayzeBio, and the company plans to develop new drugs for cancer through Mirati Therapeutics and SystImmune. Additionally, BMS signed a technology transfer agreement with Orum Therapeutics last year, which was the first collaboration on open innovation with a Korean company. BMS paid Orum Therapeutics US$180 million last year, successfully securing antibody-drug conjugate (ADC) technology. Mariko Hiramatsu, BMS "Until now, the company has significantly been relying on Opdivo. Not only focusing on immune checkpoint inhibitors, but we also plan to secure new pipelines in various diseases," Mariko Hiramatsu, BMS' Head of Japan in Business Development and Asia Search, stated. "BMS is interested in collaborating with global companies and partnering with Asian companies, including those in South Korea, for new drug candidates. For example, gastric and pancreatic cancers have high incidence rates in the Asia-Pacific region, and collaborating with Asian companies can enhance the potential for new drug development. Such strategies often consider regional disease prevalence to tailor drug development approaches," Hiramatsu said. "When evaluating the introduction of new drug candidates, we consider how quickly milestones can be achieved and the associated investment costs, which are also key factors." "The contract with Orum Therapeutics is one of the important contracts for BMS. We aim to bolster innovation in South Korea and focus on developing new drugs for global patients," Hiramatsu emphasized. Continue to invest in fields where they have strengths…Novo Nordisk searches new drug candidates for treating diabetes·obesity·MASH Novo Nordisk said the company will continue investing in areas where they have strengths. The company has drugs that belong to a class of GLP-1 and obesity treatments, including Saxenda, Wegovy, Ozempic, and Victoza. The company's chief focus is developing new drug candidates for metabolic diseases, such as MASH treatments. To bolster its pipeline, Novo Nordisk pulled off M&A deals one after another. In August 2023, Novo Nordisk acquired Inversago Pharma, a company specializing in developing new drug candidates for obesity, at US$1.1 billion (about KRW 1.5 trillion), strengthening their obesity pipeline. Inversago Pharma is developing INV-202, a CB1 receptor-based novel drug candidate for diabetes·obesity. According to Phase 1 clinical trial results, INV-202 has demonstrated tolerability and safety in adult patients showing signs of metabolic syndrome. After that, Novo Nordisk acquired the Danish biotechnology company Embark Biotech. Embark is a spinout company from the Novo Nordisk Foundation in 2017. Embark Biotech is developing 'EMB1,' a novel obesity treatment candidate targeting the G-protein-coupled receptor on fat cells. Calvin Chen, Associate Director of Global Search & Evaluation at Novo Nordisk "Novo Nordisk remains open to various possibilities and is not solely focused on late-stage drug candidates in Phase 3 clinical trials. We are interested in all competitive drug candidates in our key areas of expertise, including obesity, diabetes, and MASH," Calvin Chen, Associate Director of Global Search & Evaluation at Novo Nordisk, stated. Chen added, "Our focus is on sustainability. We are seeking an open innovation partner who is responsible for various aspects, such as societal and environmental aspects."

- Company

- Industry eyes myelofibrosis drug Ojjaara’s reimb progress

- by Eo, Yun-Ho Nov 22, 2024 05:55am

- Interest is gathering on the insurance reimbursement of Omjjara, a targeted therapy for myelofibrosis. According to industry sources, GSK Korea is preparing to submit a reimbursement application for its myelofibrosis drug, Ojjaara (momelotinib) in Korea. The company is expected to submit its application next month (December). Specifically, the indication the company will apply for reimbursement is for the “treatment of myelofibrosis in intermediate- or high-risk adults with anemia.” The drug’s approved indication includes both primary myelofibrosis and myelofibrosis post-polycythemia vera (PV) and post-essential thrombocythemia (ET). Unlike existing drugs that act on a single target, Ojjaara is a multi-target drug that blocks all three major signaling pathways that lead to the disease, providing a potent treatment effect. The drug blocks three key signaling pathways, including the JAK1 and JAK2 proteins that were inhibited by existing therapies, and the ACVR1 (activin A receptor type). The recommended dose is 200 mg orally once daily and can be taken with or without food. Myelofibrosis is a rare blood cancer in which the bone marrow becomes fibrotic, causing symptoms such as anemia, thrombocytopenia, and spleen and liver enlargement. It affects about 1 in 100,000 people worldwide, and in Korea, about 2,292 patients were confirmed to have received inpatient and outpatient treatment for the condition as of 2023. Patients with anemia symptoms in particular have a poor prognosis, and the problem is that the majority of patients experience anemia. In one study, 87% of patients with myelofibrosis were anemic at the time of referral, and in another study, 46% of patients required a blood transfusion more than a year after diagnosis. In general, the development of anemia in myelofibrosis patients doubles the risk of death compared to other prognostic factors such as age, leukocytosis, and systemic symptoms. In 2 global Phase III clinical trials - the SIMPLIFY-1 study and the MOMENTUM study - Ojjaara confirmed the clinical efficacy and safety profile of anemia in adult myelofibrosis patients, including the treatment of key symptoms such as improved splenomegaly and reduced transfusion dependency in patients with anemia. The SIMPLIFY-1 study directly compared Ojjaara to ruxolitinib in 432 adult myelofibrosis patients who had not previously received JAK inhibitor therapy, with a post hoc analysis in the anemia subgroup. The results demonstrated non-inferiority of Ojjaara to ruxolitinib for the primary efficacy endpoint of spleen volume response (>35% reduction) at 24 weeks of treatment but did not show non-inferiority in terms of total symptom score improvement. The proportion of patients in each arm who were transfusion-free was 66.5% in the Ojjaara arm and 49.3% in the ruxolitinib arm, with significantly lower transfusion dependence (better transfusion independence) in the Ojjaara arm. In the MOMENTUM study, another pivotal trial, which evaluated the efficacy and safety of Ojjaara versus danazol in 195 adult patients with myelofibrosis who were previously treated with a JAK inhibitor and had symptoms and anemia. All subjects enrolled in the study had previously received ruxolitinib, and 4.6% had received fedratinib. The co-primary efficacy endpoints were the proportion of patients with a 50% or greater reduction in Total Symptom Score (TSS) at 24 weeks of treatment and transfusion independence. Key secondary endpoints included spleen volume response.