- LOGIN

- MemberShip

- 2025-12-22 13:31:20

- Company

- Premium meningitis vaccine Bexsero lands in hospitals in KOR

- by Eo, Yun-Ho Nov 18, 2024 05:49am

- The next-generation meningococcal vaccine, ‘Bexsero’ can now be prescribed in general hospitals in Korea. According to industry sources, GSK Korea’s Bexsero, the first meningococcal B vaccine introduced to Korea, has passed the drug committees (DCs) of the Big 5 tertiary hospitals, including Samsung Medical Center, Seoul National University Hospital, Seoul St. Mary's Hospital, Seoul Asan Medical Center, and Sinchon Severance Hospital. Kyungpook National University Hospital, Korea University Anam Hospital, Korea University Ansan Hospital, Inje University Paik Hospital, Seoul National University Bundang Hospital, Seogwipo Medical Center, Ajou University Hospital, and Pusan National University Yangsan Hospital. Meningococcal infections can cause invasive meningococcal infections, meningitis, and sepsis. Invasive meningococcal infection progresses rapidly and can cause death within 24 to 48 hours of the onset of symptoms. Even with treatment, the disease is deadly, with a fatality rate of 8-15%. Typical serogroups of meningococci that cause invasive meningococcal infections in humans include A, B, C, W, X, and Y. The most predominant meningococcal serogroup in Korea, the United States, and Europe are serogroup B, with high levels found in infancy and adolescence. From 2010 to 2016, the proportion of meningococcal B serogroup cases identified in Korea was 28%, but from 2017 to 2020, the rate increased significantly to 78%. Meningococcal B's capsular polysaccharide is structurally similar to human tissue, which has made vaccine development challenging due to the risk of autoimmune damage. GSK developed Bexsero by applying novel technologies that employ genome sequencing. Since its initial European approval in 2013, GSK has accumulated over a decade of experience in preventing meningococcal B infections, conducting 17 studies on subjects aged 2 months to adults. Professor Hyunmi Kang, Department of Pediatrics at St. Mary's Hospital in Seoul, said, "The prevalence of meningococcal serogroups varies across countries and time periods, so it is not easy to predict. In Korea, serogroup B meningococcal infection cases have increased in recent years, increasing the need for its prevention.”

- Company

- 'Tevimbra' can be prescribed at general hospitals

- by Eo, Yun-Ho Nov 18, 2024 05:49am

- 'Tevimbra,' a type of immune checkpoint inhibitor, is becoming more widely available for prescription at general hospitals. According to industry sources, BeiGene's PD-1 inhibitor Tevimbra (tislelizumab), which has applied for reimbursement for its esophageal cancer indication, has passed the drug committees (DC) of tertiary general hospitals, including Samsung Medical Center, Seoul National University Hospital, Seoul St. Mary's Hospital, and Asan Medical Center. Tevimbra is a PD-1 inhibitory immune checkpoint inhibitor that demonstrated clinical usefulness as the second-line therapy for esophageal squamous cell carcinoma. It was approved in South Korea in November 2023. The drug passed the Cancer Disease Review Committee (CDRC) of the Health Insurance Review and Assessment Service (HIRA) in August in its second attempt and is awaiting consideration for the Drug Reimbursement Evaluation Committee (DREC) review. Since there haven't been any immune checkpoint inhibitors with reimbursement for esophageal cancer, it remains to be watched whether Tevimbra will become available as the new treatment option. Currently, seven immune checkpoint inhibitors have been approved or authorized for marketing in South Korea, including ▲Keytruda ▲Opdivo ▲Tecentriq ▲Imfinzi ▲Bavencio ▲Jemperli ▲Tevimbra. The number of indications for these drugs totals 64. However, only 21 therapies are reimbursement-listed (about 33%). None of these drugs are included on the reimbursement list for the treatment of esgophageal cancer. In South Korea, platinum-based anticancer chemotherapy is approved for reimbursement as both first-line therapy and second-line therapy or higher for esophageal squamous cell carcinoma. The low reimbursement rate for immune checkpoint inhibitors in each indication, such as esophageal cancer, is due to drug price and finance. It has been known that after drugs were reimbursed for treating several cancer types, such as lung cancer, the overall claim amount for immune checkpoint inhibitors and the percentage of anticancer agents under the National Health Insurance significantly increased, resulting in a financial burden. Based on the 2023 report, the claim amount of anticancer agents was KRW 2.4 trillion. The claim amount for immune checkpoint inhibitors was about KRW 500 billion, accounting for 20% of the anticancer agents' claims. Patients have high hopes for BeiGene's Tevimbra because the company announced the drug supply at a relatively lower price. BeiGene has already demonstrated its 'Fair pricing of innovative new drugs' philosophy to eliminate potentially excluded patients through the reimbursement procedure for the blood cancer treatment, 'Brukinsa (zanubrutinib).' Meanwhile, the global Phase 3 clinical RATIONALE-302 study showed Tevimbra prolonged the median overall survival (OS) by 2.3 months compared to chemotherapy (8.6 months vs. 6.3 months), statistically reducing the death risk by 30%. The response rate was twofold higher in Tevimbra compared to chemotherapy (20% vs. 10%), and Tevimbra extended the median duration of response (DOR) by approximately three months, from 4.0 months to 7.1 months. As a result, the National Comprehensive Cancer Network (NCCN) Guidelines were revised, detailing Category 1 recommendation for Tevimbra as a favorable option for second-line therapy for esophageal squamous cell carcinoma.

- Company

- Demand rises for reform of the cancer drug reimb system

- by Moon, sung-ho Nov 18, 2024 05:49am

- With the presence of new anticancer drugs increasing in the clinical field, the pharmaceutical industry has been demanding the authorities apply a new reimbursement model in Korea. In addition to the existing immuno-oncology drugs, the emergence of antibody-drug conjugates (ADCs), which have proven effective in various cancers, has led to calls for different drug prices for each 'indication.’ # These calls have been mainly coming from multinational pharmaceutical companies that own new anticancer drugs, but they have been met with a lukewarm response in the field. The reason is that the system they requested considers the profitability of companies rather than the patients. According to industry sources on the 9th, as immuno-oncology drugs or ADCs with indications for various cancer types have recently been introduced to the field, the opinion has been raised on how different drug prices should be applied to the same drug by indication. The system, indication-based pricing (IBP), is a further subdivision of value-based pricing (VBP), which states that drug prices should reflect the actual value of drugs. Currently, the single-price policy used by Korea’s health insurance system bases a drug’s price on the initial indication. For each additional indication that is covered, the existing drug’s price must be reduced to reflect the expanded scope of coverage. For example, if an immuno-oncology drug called A is initially approved for lung cancer, and then expands its indication to gastric and breast cancer, the existing price must be reduced through negotiation to reflect the increased use in practice. The problem is that an increasing number of drugs have indications for multiple cancers, including major immuno-oncology drugs and ADCs, and as demand for their reimbursement is rising, the current single-price system cannot accommodate all the indications. One such treatment is MSD Korea's immuno-oncology drug Keytruda (pembrolizumab). As of August, Keytruda was approved in Korea for 33 indications in 17 different cancers. Since last year company has been pushing to expand reimbursement for Keytruda. It has applied for reimbursement of a total of 17 indications in Korea but has not been able to cross the Cancer Disease Deliberation Committee’s threshold. After applying for reimbursement for 13 of its indications last year, the company has added 4 more indications this year: ▲MSI-H gastric cancer, ▲MSI-H biliary tract cancer, ▲HER2-positive gastric cancer, and ▲HER2-negative gastric cancer. MSD Korea recently submitted an additional financial-sharing proposal that included a gastric cancer indication and is reportedly making every effort to cross the CDDC threshold. The multinational pharmaceutical industry is of the opinion that the government should consider treatments with multiple indications, including immuno-oncology drugs such as Ono Pharmaceutical’s Opdivo (nivolumab), Roche’s Tecentriq (atezolizumab), AstraZeneca’s Imfinzi (durvalumab), and ADCs represented by Enhertu (trastuzumab deruxtecan), and the autoimmune disease treatment, Sanofi’s Dupixent (dupilumab). “In the current system, we have to apply for the reimbursement of each indication separately, which means that we have to continuously conduct negotiations with the government,” said one multinational pharmaceutical industry official. ”I think the need for indication-specific pricing, which is being adopted in some countries overseas, is a reference to the need that we need to find a more efficient way to work the system.” In fact, major countries such as the United Kingdom, France, Germany, Italy, Japan, Switzerland, and the United States have adopted indication-specific pricing, said the official. “The use of a single drug for multiple indications will be increasing not only in cancer but also in other diseases,” said the official. “We need a more comprehensive approach.” Then how do clinicians who actually use the drugs on-site feel about the need? First of all, the pharmaceutical industry’s dominant opinion is that IBP is necessary for 'multinational pharmaceutical companies,' but believes in the need for a cautious approach in implementing the system. This means that while the need is acknowledged, patient consent should be prioritized. For now, the demand is more focused on the profit logic of pharmaceutical companies than an improvement on the patient’s part. “With the rising number of anticancer drugs that hold multiple indications, I do agree on the need to calculate drug prices by indication,” said Dr. Shin-kyo Yoon, Professor of Oncology at Asan Medical Center, ”but the opinions of patients are more important than ours. It is not easy because the entire system would need to be reorganized.” Another professor of oncology at a university hospital said, “It's not an easy problem, as the price cuts in the current system are entirely borne by the drug companies. The IBP seems to have come about because they have to apply for reimbursement while avoiding drug price reductions and receive approval for the additional indications. In the end, it's a problem that the government should need to address.” As such, introducing IBP has been mentioned during the National Assembly's audit, which ended last month. However, the Ministry of Health and Welfare and the Health Insurance Review and Assessment Service did not specifically mention the need for such a system, saying that the necessity of the system should be reviewed first. At the same time, the authorities stated that it is time to think about how too much of Korea’s health insurance finances are being spent on reimbursing anticancer drugs. The MOHW said, “We will review the necessity of introducing a Korean-style IBP system that reflects the value of each indication by comprehensively considering various factors such as expanding access to new drugs and the impact on health insurance finances. However, we would need to conduct literature reviews, explore domestic and foreign cases, evaluate its operability within the current drug pricing system and the national health insurance system, and calculate the benefits of introducing the system comprehensively.” It added, “The post-settlement method, in which the actual price is set differently for each indication and then settled between the payer and pharmaceutical companies, requires sufficient review and public discussion on the method of calculating drug prices by indication and the reimbursement method between the payer and pharmaceutical companies.” “In the case of anticancer drugs, many good drugs are being released, but at a higher than we expected,” said Kook-hee Kim, Director of the Pharmaceutical Management Division at HIRA. ”Recently, we have been managing finances by adjusting the reimbursement standards for artificial tears and choline alfoscerate drugs, but there is a concern on whether such saved finances should be solely invested in anticancer drugs.”

- Company

- Six reimbursement revaluations fail in 4 years

- by Chon, Seung-Hyun Nov 15, 2024 05:49am

- Six items have been removed from the reimbursement list after reimbursement reevaluations during the past 4 years. Silymarin bilberry fruit dried powder, followed by itopride, failed the reimbursement reevaluations. Streptokinase - streptodornase, oxiracetam, and acetylcarnitine were also removed due to reimbursement reevaluation failures. Pharmaceutical companies are facing annual losses of up to KRW 240 billion as a result of the 6 drugs' reimbursement reevaluation failures. According to the Ministry of Health and Welfare on the 14th, 55 itopride-based drugs have been removed from the reimbursement list as of this month. The move follows the government's reimbursement revaluation. The health authorities selected 7 ingredients, including thioctic acid, pranlukast, itopride, sarpogrelate, levodropropizine, mosapride, and formoterol, to be reevaluated this year. As a result, the authorities concluded that itopride lacked clinical efficacy and was removed from the benefit. Three components - thioctic acid, pranlukast, and mosapride - were recognized as clinically useful and will remain on the reimbursement list. In the case of sarpogrelate and levodropropizine, the two will be removed from the reimbursement list but will remain covered if pharmaceutical companies voluntarily reduce their prices. The decision of formoterol was deferred pending clinical reevaluation by the MFDS, with the condition that the NHIS will recollect a portion of their reimbursement costs if the drugs fail to prove clinical efficacy. This means that only itopride fully failed the reimbursement reevaluations, and all products containing itopride will be removed from the reimbursement list. Itopride products from JW Life Science, JW Pharmaceutical, Kuhnil Biopharm, KyungDong Pharm, Kwangdong Pharmaceutical, Kukje Pharm, Nexpharm Korea, Novem Healthcare, NEWGEN Pharma, Daewon Biotech, Daewon Pharmaceutical, Dongsung Pharm, Dongwha Pharmaceutical, Mother’s Pharmaceutical, Medix Pharm, Bukwang Pharmaceutical, Samsung Pharm, Celltrion Pharm, Sinil Pahramcetucial, Shinpoong Pharmaceutical, iCure Pharmacueticals, Ahngook New Pharm, Ahngook Pharmaceutical, Alvogen Korea, SPC, Neo Bio Korea Pharm, Youngil Pharm, Young Poong Pharmaceutical, Yuyu Pharma, Yuhan Corp, Eden Pharma, Reyon Pharmaceutical, Intro Biopharma, Il-Yang Pharmaceutical, Ilwha, Jeil Pharmaceutical, Chong Kun Dang, Jinyang Pharmaceutical, Cosmax Pharma, PharmaKing, Poonglim Pharmatech, Hana Pharm, BMI Korea, Abbott Korea, Union Korea Pharm, Korus Korea, Korea Pharma, Pharmbio Korea, PMG Korea, Hutecs Korea Pharmaceutical, Han Wha Pharma, Whan In Pharm, Huons Meditech, Huons Life Sciences, will be withdrawn from the reimbursement market. Itopride is used to treat digestive symptoms caused by functional dyspepsia. According to the drug research institution UBIST, it generated KRW 23.6 billion in outpatient prescriptions last year. Itopride's prescription volume has decreased 18.7% in 5 years from KRW 29.1 billion in 2019 but has maintained prescription sales of over KRW 20 billion annually. From the pharmaceutical companies’ perspective, the reimbursement cut for itopride means a loss of more than KRW 20 billion a year. During the various reimbursement reevaluations that were conducted since 2021, a total of 6 ingredients were removed from the reimbursement list. In 2021, the health authorities announced a plan to reevaluate the reimbursement adequacy of 5 ingredients, including ▲grape seed extract Vitis vinifera (grape seed and grape leaf extract), ▲avocado soya, ▲ginkgo biloba dried extract, ▲bilberry dry extract, and ▲ silymarin. Among them, silymarin and bilberry dry extract were concluded to be inadequate for reimbursement and were removed from the health insurance reimbursement list. For both silymarin and bilberry dry extract, the prescription market has not been eliminated as some products that have filed administrative lawsuits have retained their reimbursed status. However, the prescription market has shrunk significantly due to the mass breakaway of products that accepted the reimbursement deletion. Silymarin's prescription market size grew 44.6% over 3 years, from KRW 23.6 billion in 2019 to KRW 34.1 billion in 2022, showing a significant increase in demand in the prescription market. Silymarin is an OTC drug used for toxic liver disease, hepatocyte protection, chronic hepatitis, and cirrhosis. However, after failing reimbursement reevaluations, sales fell to KRW 26.7 billion in 2022, down 21.5% from the previous year, and then to KRW 25.7 billion last year, down 24.8% from 2 years ago. Last year, the prescription amount of bilberry dry extract was KRW 13.3 billion, down 30.3% from the previous year. Bilberry dry extract is a drug used to improve retinal degeneration and vascular disorders of the eye caused by diabetes. The prescription market for bilberry dry extract was worth KRW 31 billion in 2021, but after the government deleted its reimbursement status, sales dropped 38.5% to KRW 19.1 billion in 2022 and shrank further last year. Prescriptions for bilberry dry extract last year shrank by 57.1% compared to two years ago. Streptokinase - streptodornase (Strepto preparations), oxiracetam, and acetyl L-carnitine, which were eligible for reimbursement but failed to pass the MFDS’s clinical reassessment, have seen their prescription market decline to the point of extinction. Last year, the prescription market for strepto preparations was KRW 16.1 billion, down 41.0% from the previous year. In 2022, the MFDS determined the strepto preparations lacked clinical efficacy during reimbursement reevaluations. However, given the ongoing clinical reassessment, conditional reimbursement was offered to defer the reimbursement reevaluation results only for items that agreed to refund the reimbursed costs based on the outcome of the clinical reevaluation. Strepto preparations are used for the “relief of acute inflammatory edema caused by ankle surgery or trauma to the ankle” and “difficulty in bile drainage accompanying respiratory diseases.” In 2017, the MFDS ordered a clinical reevaluation of strepto preparations after controversy arose over their efficacy. However, the clinical reevaluation failed to prove their efficacy, and the drug was excluded from the health insurance reimbursement list in December last year, the the indications were also deleted. Oxiracetam and acetyl L-carnitine were selected for reimbursement reevaluations last year but failed clinical reevaluations and were unable to proceed to reimbursement reevaluations. In January, the prescription and dispensing of oxiracetam was discontinued after the clinical reevaluation failed to verify the drug’s efficacy. Oxiracetam was approved for the treatment of cognitive impairment caused by Alzheimer's disease, multiple sclerosis, and temperamental brain syndrome due to brain dysfunction. Oxiracetam generated KRW 23.2 billion in prescription sales in 2022, but its clinical reevaluation failure wiped out the prescription market. Acetyl-L-carnitine was subject to reimbursement reevaluations in 2023 but was not evaluated due to its failure to pass clinical reevaluations. Acetyl-L-carnitine is licensed for use in “primary degenerative diseases” or “degenerative diseases secondary to cerebrovascular diseases.” In 2013, the MFDS ordered a clinical reevaluation of acetyl-L-carnitine preparations. However, in 2022, the indications were removed due to the drug’s failure to demonstrate efficacy in both indications. Acetyl-L-carnitine had a prescription market worth KRW 77.9 billion in 2019, but its removal from both the approval and reimbursement list led to losses for pharmaceutical companies. The 6 ingredients that were removed from the reimbursement list among those subject to reimbursement reevaluations over the past 4 years since 2021 had a combined prescription volume of KRW 242.3 billion in 2019. Pharmaceutical companies have realized an annual loss of KRW 242.4 billion in prescription sales due to the removal of the 6 ingredients.

- Company

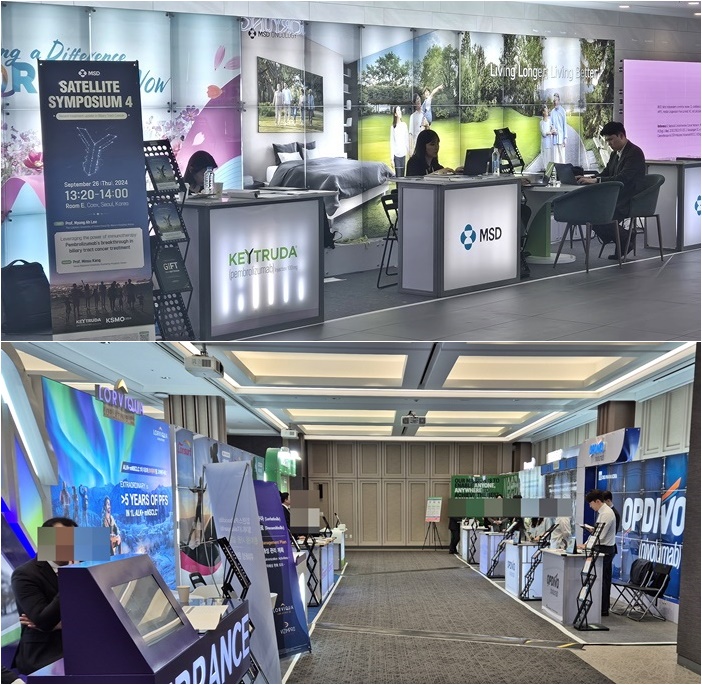

- Leqvio with 'twice-yearly treatment' set for mkt

- by Whang, byung-woo Nov 15, 2024 05:49am

- Leqvio is set to challenge the market with its superior drug tolerance, administered twice yearly, compared to existing treatments. Product photo of Leqvio.According to the pharmaceutical industry on November 15, Novartis Korea launched the siRNA therapy Leqvio (inclisiran) on November 11. Lecvio is the first-in-class siRNA drug approved in South Korea. It is approved as an adjunct to dietary therapy for patients with primary hypercholesterolemia (heterozygous familial and non-familial) and mixed dyslipidemia. Leqvio uses naturally occurring siRNA to block PCSK9 protein production and lower LDL cholesterol levels. It has the advantage of its twice-yearly administration by doctors, reducing the challenges associated with self-injection. Novartis is reportedly working to establish prescription access for Leqvio in general hospitals. Industry sources said that Drug Committee (DC) approvals for Leqvio are proceeding across hospitals nationwide, with some hospitals already completing the process. Novartis' Leqvio was launched in South Korea after the product became available. Novartis is expected to start building its prescription sales as the DC reviews advance within general hospitals. With Leqvio prescriptions anticipated, there is growing interest in how Novartis’ domestic sales strategy will unfold. Although specific details have not yet been announced, it is anticipated that Novartis will consider either utilizing its own sales line or engaging in co-promotion with a Korean company. Leqvio's competing drug, Amgen’s Repatha, is co-marketed with Jeil Pharmaceutical. However, given Leqvio’s potential focus in general hospitals, Novartis may utilize its internal sales team. Will Leqvio lead the prescription trend? It will depend securing reimbursement Experts anticipate that Leqvio will have a market presence despite cost hurdles, as cholesterol management trends evolve to prioritize patient convenience along with clinical effectiveness. For hypercholesterolemia patients, maintaining LDL-cholesterol (LDL-C) at recommended levels consistently and early on is crucial in reducing the risk of atherosclerotic cardiovascular disease (ASCVD). Long-term strategies are anticipated to shift toward minimizing the frequency of medication doses for patients, with an increased focus on injection therapies that allow healthcare providers to monitor patient progress directly. "While statins require daily use and Repatha requires 26 injections annually, Leqvio is administered in twice-yearly injections by a doctor," Dr. Byeong-Keuk Kim, a cardiologist at Sinchon Severance Hospital, said. "Doctors face difficulty when patients who don’t respond well to statins. Now, we could have Leqvio as a treatment option." "Leqvio’s six-month dosing schedule could improve drug adherence, potentially resulting in a sustained decrease in LDL-C levels and lower cardiovascular risk in clinical practice," Dr. Kyung Woo Park, a cardiology professor at Seoul National University Hospital, said. However, with the competing PCSK9 inhibitor Repatha already reimbursed, Novartis' primary aim would be on obtaining reimbursement for Leqvio. Repatha’s reimbursed cost is approximately KRW 121,000 per injection, with recommended dosing every two weeks or once monthly at 420 mg (three dosages), bringing annual treatment costs to KRW 1.45 million. Novartis is working on Leqvio's reimbursement listing. The company aims to continue negotiations with the government to establish reimbursement for Leqvio at about KRW 3 million, aligning with Repatha’s annual price. "While Leqvio may be chosen by elderly patients facing adherence challenges or those with poor prognosis, many others already experience significant improvements by combining existing therapies with regular exercise. For some, even a once-monthly Repatha injection successfully maintains desired levels. In my opinion, balancing high costs against the administration convenience needs further discussion," a cardiology professor at a major hospital in Gyeonggi-do said.

- Company

- Hanmi's new bio drug 'Rolvedon' sales 88%↑ in the US mkt

- by Son, Hyung Min Nov 15, 2024 05:49am

- The U.S. sales of Rolvedon (Korean product name: Rolontis) have substantially increased. Hanmi Pharmaceutical's U.S. partnering company, Assertio, plans to expand market share by securing Rolvedon's indication for the same-day administration. According to Assertio on Novermber 14, Rolveron's sales in the U.S. market in Q3 were US$ 15 million (about KRW 21 billion), up 87.5% Year-over-Year (YoY). Rolvedon has recorded cumulative sales of US$110.30 million (about KRW 155 billion) since its launch in Q4 of 2022. Rolvedon is a treatment for neutropenia developed by Hanmi Pharmaceutical. It is Korea's 33rd new drug, approved in March 2021. After that, Hanmi Pharmaceutical and its U.S. partnering company Spectrum (now Assertio) obtained U.S. Food and Drug Administration (FDA) approval in September of the same year. Rolvedon was outlicensed to the U.S. Spectrum in 2012. After Assertio acquired Spectrum in April last year, it secured the licensing of sales and development of Rolvedon and lung cancer therapy Poziotinib. Rolvedon Since its release in the United States in October 2022, Rolvedon has recorded sales of $10 million within three months. After the product launch, 70 distributors purchased Rolvedon. It was then utilized by the top three community oncology networks, accounting for 22% of the clinic market share. It continued to show strong sales up to Q2 last year. Rolvedon generated sales of $15.6 million in Q1 last year, and in Q2, it recorded $21 million (approx. KRW 28 billion), an increase of 34.6% from the previous quarter. Rolvedon’s sales in Q3 last year slowed down since its launch. It recorded $8 million in Q3 last year, a decrease of 62% from the previous quarter. Regarding sales reduction, Assertio explained that the demand for Rolvedon after applying the reimbursement system was below expectations. Rolvedon successfully rebounded in Q4 last year, generating US$11 million in sales. Rolvedon's sales in Q1 amounted to US$14.50 million and maintained recovery in Q2, recording sales of US$15.10 million. Assertio has high hopes for Rolvedon's same-day administration clinical trial. Currently, Neulasta, jointly developed by Amgen and Kyowa Kirin, is recording over half of the market share in the U.S. market for neutropenia treatment. However, conventional treatments for neutropenia, such as Neulasta, can only be administered 24 hours after cancer therapy, thereby prolonging hospitalization. Assertio plans to gain a competitive edge with its strategy of Rolvedon's same-day administration method. Assertio has recently completed the Phase 1 clinical trial for Rolvedon's same-day administration. The company plans to present the clinical results at the 2024 San Antonio Breast Cancer Symposium (SABCS 2024), held for four days, starting December 10.

- Company

- Lee Hyun-ju named as the representative of ZP Therapeutics

- by Eo, Yun-Ho Nov 14, 2024 05:52am

- Lee Hyun-ju, new representative of ZP Therapeutics Korea Lee Hyun-ju (48), ex-Daiichi Sankyo Korea's Oncology Business Franchise Head, was appointed as the new representative of ZP Therapeutics Korea. Industry sources said Zuellig Pharma has recruited Lee Hyun-ju as the new head of ZP Therapeutics Korea, Zuellig Pharma's commercial services corporation. Lee holds a degree from Sungkyunkwan University's College of Pharmacy, and she has years of experience in the Korean pharmaceutical market with expertise in the anticancer business. Lee started her career in 1999, undertook roles in Handok's marketing and Sanofi's marketing, and worked as Roche Korea's Oncology Cluster Lead and Novartis Korea's Hematology Cluster Lead. Lee moved to Daiichi Sankyo's Oncology Cluster last year and served her role until the new appointment. Meanwhile, ZP Therapeutics Korea is committed to providing a comprehensive solution, encompassing marketing, sales promotion, product launch medical e-detailing, registration & approval, market access, digitalization & data analysis-based sales excellence, adapting needs and changes of the pharmaceutical market. ZP Therapeutics Korea established itself as a commercial solution partner sought by pharmaceutical clients. The company is involved in in-licensing of many prescription drugs and over-the-counter (OTC) drug brands. ZP Therapeutics Korea also provides sales & marketing services, supporting major pharmaceutical companies.

- Company

- Celltrion anticipates Trump admin will bring positive shift

- by Whang, byung-woo Nov 14, 2024 05:51am

- Celltrion anticipates that President-elect Donald Trump's second administration in the United States will positively affect the company's biosimilars and Contract Development and Management Operations (CDMO) services. On November 12, Celltrion presented stockholders with the potential impact on the business under the title 'The Business Impact and Outlook upon President-elect Donald Trump's second administration in the United States launches.' Celltrion cited a report from the Korea Institute for Industrial Economics and Trade, 'The potential impacts of the U.S. presidential election on Korean industry and outlook,' and analyzed that the Trump administration will be friendly towards using generics and biosimilars. Currently, healthcare expenditures in the United States accounted for 17.6% of the country's GDP in 2023. As a solution, Trump's first administration implemented initiatives such as the 'Lowering Drug Prices by Putting America First' administrative orders and the 'American Patients First' plan to lower drug prices. These policies include details regarding biosimilars, including 'Improve Competition' and 'Lowering List Prices.' "When President-elect Trump's second administration launches, the administration is expected to take over the policy during the first administration and pursue healthcare policy," Celltrion said. "We expect the administration will favor expanding biosimilar prescriptions, which is Celltrion's main business." Trump's first administration pursued a policy of regulating drug pricing, proposing a bill to Congress to stop pharmaceutical companies from paying rebates to the top 3 pharmacy benefit managers (PBMs) in the United States. Such a move was said to be friendly to the biosimilar market. Additionally, as the administration pursues the PVM reform to alleviate financial loss, a by-product of economic stimulation, by reducing taxes, implementing a policy that expands the use of biosimilars is expected. Such a move is expected to be favorable to Celltrion. In particular, Celltrion anticipated these policies would positively impact its CDMO service, which will be Celltrion's growth momentum. The 'Biosecure Act' bill, the U.S. Congress initiative, 'prohibits entities that receive federal funds from using biotechnology from a biotechnology company of concern may not contract with any entities that do so.' The Biosecure Act is expected to support establishing a new supply network in US-friendly countries with business competitiveness, including South Korea, Japan, and India. "In line with the U.S. industry trend, we will complete establishing the CDMO corporate entity within this year to seize the opportunity to secure demands from Chinese companies," Celltrion added. "Celltrion will secure a new manufacturing plant, as Celltrion's 100% owned subsidiary, in South Korea or overseas to expand production capacity." Additionally, as Trump's second administration's policy priority is the 'America First' agenda, Celltrion anticipates US dollar strength will likely result in trade disputes and interest rate rises. During the process, Celltrion anticipates its products will remain unaffected by tariff increases, as tariffs on drugs are exempt under the WTO's Pharma Agreement. "Upon Trump's second administration launches, we expect the company will have an opportunity to focus mainly on business aspects, marketing expansion and sales growth, compared to other type of business," Celltrion said. "Celltrion will focus on changes to the U.S. biopharmaceutical industry and generate outcomes by maximizing business opportunity," Celltrion emphasized.

- Company

- ‘Access to bispecific antibody Columvi should be improved’

- by Son, Hyung Min Nov 14, 2024 05:51am

- Dr. Chris Fox, Professor of Haematology at the University of Nottingham, U.K. “Diffuse large B-cell lymphoma (DLBCL) is a disease in which one in four patients experience relapse even after treatment. The bispecific antibody Columvi has demonstrated efficacy in relapsed patients at up to 18 months of follow-up. The clinical performance of Columvi is not just an incremental improvement over existing therapies, but a paradigm shift in the DLBCL treatment environment.” At a recent meeting with Dailypharm, Dr. Chris Fox, Professor of Haematology at the University of Nottingham, U.K., recently described so about Columbo, a bispecific antibody approved for diffuse large B-cell lymphoma in Korea. DLBCL is a disease in which the body's protective “B cells” grow or multiply uncontrollably and is the most common form of non-Hodgkin's lymphoma that accounts for about 40% of all non-Hodgkin's lymphomas. The disease is characterized by aggressive, rapidly progressive staging. The number of DLBCL patients in Korea was 14,183 as of last year, a 36% increase from the 10,428 in 2018. Up to 15% of DLBCL patients fail first-line standard therapy, and 25% of patients experience relapse within 18 months despite achieving a complete response (CR). Patients with relapsed or refractory DLBCL show a characteristically rapidly worsening prognosis as the number of treatment cycles increases. Columvi, the first bispecific antibody targeting CD20XCD3 enters the market...offers the advantage of a fixed dosing period The good news is that a variety of new drugs have emerged for this disease. Roche's Polivy, a representative DLBCL drug, is said to be effective in about two-thirds of patients when used as a first-line treatment. However, this means that about one-third of patients who do not respond to first-line treatment remain in need of further options. Bispecific antibodies and chimeric antigen receptor T-cell (CAR-T) therapy, such as Columvi, are used in such cases of relapse. Columvi, the first bispecific antibody to target CD20xCD3 in DLBCL, was launched without reimbursement in Korea in May and is now on the formulary of more than 10 general hospitals. The drug has a 2:1 structure that binds to two CD20 regions on the surface of malignant B cells and one CD3 region on immune T cells, resulting in a stronger binding. Bispecific antibodies have two targets, each targeting a different cell: one that draws immune T cells closer to malignant B cells and the other that activates the T cells to kill the malignant B cells. Based on this mechanism of action, bispecific antibodies have been shown to be effective in patients who are resistant to conventional antibody therapies or chemotherapy. “Bispecific antibodies and CAR-T therapies have been explored as treatment options for DLBCL, but without head-to-head trials, it is difficult to say which is better. The choice of treatment should be based on the individual patient's state of disease progression. However, one of the side effects of CAR-T in elderly patients, immune effector cell-associated neurotoxicity syndrome (ICANS), is considered when selecting a treatment,” said Dr. Fox. He added, “Columvi has a fixed dosing period. It is designed to be administered for up to 12 cycles (8.3 months), so there is a clear end date for the treatment. It also has the advantage of being an off-the-shelf treatment that can be administered to patients immediately.” Columvi achieves 39% CR rate - still effective after 18 months...“justifies the need for its reimbursement” Columvi demonstrated efficacy in the multicenter, open-label Phase I/II NP30179 trial in patients with relapsed or refractory DLBCL after two or more prior systemic therapies. Trial results showed that Columvi achieved a complete response (CR) of 40% and an overall response rate (ORR) of 52%. Among patients who achieved CR, the median duration of response was 26.9 months, with 67% of patients maintaining CR at 18 months. The study also included about one-third of patients who had received prior CAR-T therapy. “Columvi demonstrated a 40% CR rate in the trial, even in patients who are difficult to treat,” said Dr. Fox. This data alone confirms the efficacy of Columvi, as such data cannot be expected with existing standard treatment options, and Columvi is showing similar results in the real world to the clinical trial,” said Dr. Fox. “In DLBCL, relapse typically occurs within 12 to 18 months, and staging progresses rapidly in relapsed patients. We already have data on Columvi’s use in these patients up to 18 months of follow-up. So we can be confident about Columvi’s efficacy data and maintenance of its effect.” However, Columvi’s reimbursement was rejected in July by the Cancer Disease Review Committee, the first gateway to reimbursement in Korea, due to the lack of long-term data. Roche Korea is aiming to reapply for Columvi’s CDDC review later this year. “Patient access to Columvi has been secured in the UK with reimbursement approval,” said Dr. Fox. “This is because the health authorities have recognized Columvi as an effective treatment in DLBCL.” “Columvi is not just an improvement over existing therapies, but a paradigm-shifting treatment for DLBCL. I want to emphasize that this is a treatment that could have an impact on prolonging the survival of patients with relapsed or refractory DLBCL.”

- Company

- Global CDMOs compete to expand ADC capacities

- by Kim, Jin-Gu Nov 14, 2024 05:51am

- Global competition is heating up in the contract development manufacturing organization (CDMO) market for antibody-drug conjugates (ADCs). Major players include Switzerland's Lonza and Samsung Biologics, the world's top two CDMOs, which are competitively expanding their manufacturing facilities. Lonza recently announced the expansion of a 1,200-liter ADC manufacturing facility, while Samsung Biologics announced the start-up of a 500-liter ADC manufacturing facility within the year. According to KoreaBIO, Lonza announced on Dec. 13 (local time) that it plans to add 2 manufacturing facilities in Visp, Switzerland, to expand its 'bioconjugation' service. An additional 1,200-liter manufacturing facility will be built to produce commercial bioconjugates, including ADCs, in high volumes. At the same time, the company will expand the infrastructure of the existing facility. Construction is expected to be completed and the facility fully operational by 2028. The new manufacturing facility will provide comprehensive end-to-end lifecycle support. This includes drug manufacturing for early-stage clinical development, large-scale manufacturing for commercial supply, and finished product filling services. Lonza has been in the bioconjugate CDMO business since 2006. To date, it has produced more than 1,-00 cGMP batches for more than 70 programs. Christian Morello, Vice President, Head of Bioconjugates, Lonza, said, “We continue to see strong growth in the bioconjugates space as ADCs and other bioconjugated drugs increasingly progress towards commercialization. This investment in our multipurpose commercial bioconjugation capacity addresses the growing market demand, enables us to support the growth of our customers, and offers a flexible and integrated service for manufacturing bioconjugates.” The global CDMO market, including Lonza, has recently been intensely competing to expand capacities around ADC drugs. Samsung Biologics is building a dedicated 500-liter ADC manufacturing facility at its Songdo Biocampus in Incheon, South Korea. The company plans to finalize the construction this year and begin full-scale operation after receiving GMP approval. Lotte Biologics is expanding its ADC manufacturing facility at its Syracuse, USA plant. This is an investment of USD 80 million (approximately KRW 100 billion). The ADC manufacturing facility is currently being expanded and is targeting GMP approval in the first quarter of next year. The company is also in the process of building a related plant in Songdo, Incheon. In addition, Celltrion plans to establish a separate CDMO subsidiary while pursuing ADC drug development. Kyongbo Pharmaceutical is investing KRW 85.5 billion to build an ADC plant. The reason why domestic and foreign CDMOs are rushing to expand production capacity for ADC drugs is due to their marketability and high barriers to entry. ADC is a type of antibody conjugated with a cytotoxic drug (payload) as a linker. They have a high structural complexity compared to conventional antibody drugs, which makes the development and manufacturing process difficult, but they have emerged as the next generation of biopharmaceuticals due to their relatively high therapeutic efficacy and low side effects. Following the success of Daiichi Sankyo's breast cancer drug Enhertu (trastuzumab deruxtecan), research on ADC drugs has increased explosively worldwide. However, facilities for the development and mass manufacture of ADC drugs have not been able to keep pace. This is why an imbalance between ADC-related research and manufacturing is expected in the field. Unlike conventional antibody drug CDMOs, ADC-specific manufacturing facilities require more particular technologies. Unlike antibody drug production facilities, ADC production facilities must incorporate additional design principles because they handle cytotoxic drugs (payloads) and organic solvents. Additional design details include negative pressure design, differential pressure between cleanrooms, and airlocks to prevent the spread of cytotoxic drugs and protect operators.