- LOGIN

- MemberShip

- 2025-12-22 09:55:41

- Company

- ‘Global healthcare M&A to recover this year... AI-China’

- by Cha, Jihyun Jan 15, 2025 05:53am

- Artificial intelligence (AI) and China are expected to be the keywords for mergers and acquisitions (M&A) in the global bio and healthcare sector this year. On the 14th, KoreaBIO disclosed a report by global accounting consulting firm Ernst & Young (EY) that contained the prospects above. According to the report, 130 M&A deals were made in the global bio-healthcare sector last year, including 95 for biopharmaceuticals and 36 for medical devices. This was similar to the previous year's 130 (81 biopharma and 49 medical devices). Deal values were down significantly from the previous year. The value of M&A deals last year was USD 130 billion (approximately KRW 190 trillion), down 41% from the previous year. Unlike 2023, which was dominated by large deals in safe-haven (risk-free) assets such as government bonds, last year was full of smaller deals. Bio-Healthcare M&A Deals (Source: Bio-Healthcare M&A) The report characterizes 2024 as a “reset year” for big pharma that was digesting and integrating acquisitions made the previous year. Regulation by the U.S. Federal Trade Commission (FTC) and the implementation of the Inflation Reduction Act (IRA) contributed to a slowdown in M&A activities last year. The average M&A deal size in 2024 was USD 1 billion (about KRW 1.5 trillion), which was down 42% from the previous year. Rather than invest billions of dollars to acquire less risky, market-ready assets, companies are looking to innovate by acquiring early-stage assets that are in pre-Phase III clinical development. “This means that global bio-healthcare M&A last year was smaller but smarter than in previous years,” the report concludes. The report predicted that the market will likely recover this year, but uncertainty remains. The industry has USD 1.3 trillion (KRW 190 billion) of M&A firepower, but some regulations and policies could be in the way, it said. The report cited emerging areas of ▲AI and ▲Chinese partnerships as trends in M&A this year. Over the past 5 years, the value of healthcare AI M&A deals has exceeded USD 60 billion. Most leading companies have formed at least one partnership for AI collaboration. In 2024, the number of deals reached a record high. The number and value of deals over the past 5 years reached 41 deals in 2020 (USD 5 billion), 54 deals in 2021 (USD 16.4 billion), 77 deals in 2022 (USD 15.5 billion), 55 deals in 2023 (USD 13.9 billion), and 87 deals in 2024 (USD 13.6 billion). Trends in AI-related Bio-Healthcare M&A Deals (Source: Bio-Healthcare M&A) The largest AI-related deal to date was the August 2024 acquisition of Exscientia by Recursion Pharmaceuticals. Recursion acquired Exscientia for USD 712 million. “The surge in AI partnerships and acquisitions over the past 5 years is indicative of the opportunities that AI presents to life sciences companies,” the report said, noting that the biggest focus is on using AI to discover new drugs and optimize development. The report added, “AI is delivering benefits across the value chain, from operations to commercial strategy, and the EY CEO Confidence Index shows that life sciences CEOs see emerging technologies, including AI, as the biggest disruptors over the next 12 months, along with talent acquisition.” The report also found that China is becoming a more important partner for companies looking to transfer technology for antibody-drug conjugates (ADCs) and other novel oncology therapies. In 2023, deals involving new modalities, such as ADCs, next-generation radiopharmaceuticals, and multi-specific antibodies, had been made in the Chinese market. The report also found that 43% of M&A with Chinese companies were aimed at acquiring ADCs. AstraZeneca paid USD 1.2 billion to acquire China's Gracell Biotech. It was the first outright acquisition of an innovative Chinese company by a global Big Pharma. Novartis' purchase of Shanghai Argo Biopharmaceuticals last year was also considered potentially the largest deal. However, the U.S. Biosecure Act is seen as the biggest challenge to the growth of China's life sciences sector. “This could limit the ability of companies to collaborate across borders,” the report said, adding that “the U.S.-China relationship also faces uncertainty under the Trump administration in 2025.”

- Company

- Cholangiocarcinoma·AML targeted anticancer drug 'Tibsovo'

- by Eo, Yun-Ho Jan 15, 2025 05:53am

- Product photo of Tibsovo 'Tibsovo,' a targeted anticancer drug for cholangiocarcinoma and acute myeloid leukemia (AML), is now available for prescription in general hospitals. According to industry sources, Servier's Tibsovo (ivosidenib), a drug targeting the isocitrate Dehydrogenase 1 (IDH-1) gene mutation, has passed the drug committees (DC) of the 'Big 5' tertiary general hospitals, including Samsung Medical Center, Seoul National University Hospital, and Seoul Asan Medical Center, and medical centers, including, Gangnam Severance Hospital, National Cancer Center, Gangnam Severance Hospital, and Chungbuk National University Hospital. Following receiving approval from the Ministry of Food and Drug Safety (MFDS) in May 2024, it was officially launched in September of the same year. Since then, it has expanded prescription areas. If a patient is tested positive for IDH1 mutation, Tibsovo can be used as a ▲Monotherapy in patients with locally advanced or metastatic AML and had prior therapy ▲Combination therapy with 'azacytidine' in adult patients over 75 years with accompanying disease that cannot be treated with chemotherapy. Cholangiocarcinoma is a cancer with a poor prognosis. The five-year relative survival rate is only 28.9%. 65% of the patients with cholangiocarcinoma of the liver are found be non-operable when diagnosed. Tibsovo is the only targeted drug recommended as a Category 1, the highest grade, by the National Comprehensive Cancer Network (NCCN) for a second-line treatment for cholangiocarcinoma. According to ClarlDHy Phase 3 clinical trial, Tibsovo reduced the disease progression by 63% compared to a placebo and had a median progression-free survival (PFS) of 2.7 months (placebo 1.4 months). Also, patients treated with Tibsovo had a median overall survival (OS) of 10.3 months, which was longer over twice than 5.1 months of those treated with a placebo. Do-Youn Oh, Professor of Department of Hematology-Oncology at Seoul National University Hospital, said, "Over the last five years, the development of treatments for cholangiocarcinoma got fast. Along with new drug development, many companies are focusing on developing drugs for cholangiocarcinoma. Patients with cholangiocarcinoma need to follow physician's advice, receive treatments, and seize new opportunities such as participating in clinical trials." Meanwhile, in the AGILE Phase 3 trial involving patients with AML, Tibsovo was demonstrated to improve event-free survival (EFS) when combined with azacytidine, and the overall survival (OS) was significantly improved. The patients treated with TIbsovo had a median OS of 24.0 months (placebo 7.9 months). In a long-term follow-up study, the median OS of Tibsovo combination therapy was 29.3 months, over 3.7 fold longer than that of placebo combination therapy.

- Company

- Samsung Biologics signs largest CMO deal…KRW 2 Trillion

- by Cha, Jihyun Jan 15, 2025 05:52am

- Pic of Samsung Biologics (Source: Samsung Biologics) Samsung Biologics announced on the 14th that it has signed a contract manufacturing organization (CMO) agreement worth USD 1.41 billion (approximately KRW 2.74 trillion) with a Europe-based pharmaceutical company. This is the largest contract in Samsung Biologics' history. It represents 40% of the total order value of KRW 5.4035 trillion last year. The contract will run through December 31, 2030. The customer and product names were not disclosed due to confidentiality. With the contract, Samsung Biologics has broken its record for the largest order. The record renewal comes just 3 months after the company signed a contract worth KRW 1.7028 trillion with an Asian pharmaceutical company in October last year. Last year, Samsung Biologics further solidified its position in the global market by signing 3 “big deals” worth KRW 1 trillion in major markets including the U.S., Europe, and Asia. Last year's annual orders totaled at KRW 5.4035 trillion, the largest ever amount, a 1.5 times increase compared to the previous year. Samsung Biologics currently has 17 of the top 20 global pharmaceutical companies as customers. Based on its core order-winning competitiveness, including overwhelming production capacity, quality competitiveness, and multiple track records, the company's cumulative order total has exceeded USD 17.6 billion since its establishment. Samsung Biologics is expanding its production capacity to proactively prepare for the growing demand for biopharmaceuticals. Plant 5, a 180,000-liter production plant that will incorporate the best practices of Plants 1 through 4, is under construction and is scheduled to be operational in April. Upon completion, Samsung Biologics will have a total production capacity of 784,000L. In terms of quality, Samsung Biologics has proven its competitiveness in all stages of drug manufacturing and management, including a 99% batch success rate. As of December 2024, the company has obtained a total of 340 global regulatory approvals, including 41 from the U.S. Food and Drug Administration (FDA) and 36 from the European Medicines Agency (EMA). Its regulatory on-site inspection pass rate is also among the highest in the industry. Samsung Biologics has been participating in a series of large-scale pharmaceutical and biotech industry conferences in the U.S., Europe, and Asia to strengthen business networking and order acquisition activities. Samsung Biologics is participating in the '2025 JP Morgan Healthcare Conference', the largest investment event in the pharmaceutical and biotechnology industry that is being held in San Francisco, U.S.A., from April 13-16 to strengthen networking for business expansion.

- Company

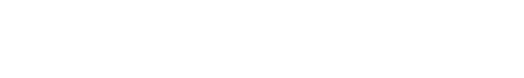

- Hanmi leads the prescription market for 7 consecutive years

- by Chon, Seung-Hyun Jan 15, 2025 05:52am

- Hanmi Pharmaceutical has led the domestic outpatient prescription market for 7 consecutive years. The company has solidified its lead in the market fueled by the strong performance of the new combination drugs it developed with its R&D capabilities. Large pharmaceutical companies such as Chong Kun Dang, Daewoong Pharmaceutical, Yuhan Corp, HK Inno.N, and Daewon Pharm showed high growth due to the strong performance of their flagship drugs that include new drugs and new combination drugs. According to drug research institute UBIST on the 15th, Hanmi Pharmaceutical posted the highest prescription sales among domestic and foreign pharmaceutical companies in the outpatient prescription market last year, up 7.1% from the previous year to record KRW 995.1 billion. Hanmi Pharmaceutical has held the lead in Korea’s market for 7 consecutive years since it first took the lead in prescription sales in 2018. Hanmi Pharmaceutical showed a steady rise in prescription sales from KRW 659.1 billion in 2019 to last year, expanding by 51.0% over the past 5 years. The gap between Hanmi Pharmaceutical and the second-place Chong Kun Dang was only KRW 63.1 billion in 2019, but last year, the gap increased to KRW 259.3 billion, establishing a solid lead in Korea’s market. Hanmi Pharmaceutical's strong sales in the prescription market were driven by its self-developed combination drugs. Rosuzet generated KRW 210.3 billion in outpatient prescriptions last year, up 17.6% year-on-year. Rosuzet is a combination of two ingredients, rosuvastatin and ezetimibe. Rosuvastatin is the first domestically developed drug to exceed KRW 200 billion in annual prescriptions, rising to lead the outpatient prescription market. Rosuzet has been setting new records every year since its launch. It has expanded 167.2% over the past five years from KRW 78.7 billion in prescriptions in 2019. Since 2020, Rosuzet has recorded prescription sales of more than KRW 100 billion for 4 consecutive years, surpassing KRW 200 billion last year. Prescriptions of Amosartan, a combination antihypertensive drug, recorded KRW 91.1 billion last year, up 2.2% from the previous year. Amosartan is a combination of amlodipine and losartan. Prescription of Amosartan Plus recorded KRW 31.5 billion last year, up 1.9% from the previous year. Amosartan Plus is a combination of three drugs used to treat high blood pressure: amlodipine, losartan, and chlorthalidone. Among the Amosartan family of products developed based on Amosartan, Amosartan XQ showed the strongest growth. Last year, Amosartan XQ's prescription sales reached KRW 12.7 billion, an increase of 21.0% year-on-year. It has nearly doubled in 2 years from KRW 6.6 billion in 2022. Launched in 2021, Amosartan XQ is a combination of Amosartan, rosuvastatin, and ezetimibe. Last year, large domestic pharmaceutical companies in general performed well in the prescription market. Chong Kun Dang posted outpatient prescription sales of KRW 735.8 billion last year, up 3.2% from the previous year. Chong Kun Dang has been ranked second in the prescription market after Hanmi Pharmaceutical for 7 consecutive years since 2018. The company's prescription sales decreased by 3.3% from KRW 619.8 billion in 2020 to KRW 599.5 billion in 2021 but has shown growth for 3 consecutive years from the following year. Prescription sales of the combination drug Telminuvo amounted to KRW 57.3 billion last year, up 5.9% from the previous year. Telminuvo is a combination drug that combines two antihypertensive drugs (telmisartan + s-amlodipine). Telminuvo’s sales continued to grow, increasing 35.3% over 5 years from KRW 42.3 billion in prescriptions in 2019. Choline alfoscerate-based brain function enhancer Chong Kun Dang’s Gliatamin recorded KRW 121.3 billion in prescriptions last year, up 8.5% from the previous year. Daewoong Pharmaceutical recorded KRW 615.3 billion in outpatient prescriptions last year, up 7.0% from the previous year. It has expanded 38.9% in 5 years from KRW 442.9 billion in 2019. The new drug Fexuclue led to the rise with a high growth rate. Last year, prescription sales of Fexuclue reached KRW 78.8 billion, up 47.3% YoY. Launched in July 2022, Fexuclue is a potassium-competitive acid blocker (P-CAB) drug for the treatment of GERD. In its first year on the market, Fexuclue recorded prescription sales of KRW 12.9 billion (USD 11.9 million) and soared more than sixfold in two years. Daewoong Pharmaceutical has been co-marketing the drug with Chong Kun Dang since April last year to strengthen its sales power. Yuhan Corp recorded prescription sales of KRW 540.4 billion last year, up 7.6% from the previous year. Outpatient prescriptions for the new anti-cancer drug Leclaza reached KRW 47.8 billion last year, up 91.5% year-on-year. Leclaza is a treatment for non-small cell lung cancer that was approved in January 2021 as the 31st new drug developed in Korea. Since then, outpatient prescriptions for Leclaza surged after Korea’s health insurance reimbursement coverage has been expanded to include it as a first-line treatment. HK Inno.N’s outpatient prescriptions amounted to KRW 522.1 billion last year, up 6.0% from the previous year. K-CAB, a P-CAB-based GERD drug, posted a 24.4% year-on-year increase in prescriptions to KRW 196.9 billion. K-CAB made a splash in 2019 with its first prescription sales of KRW 30.4 billion and has soared more than sixfold in 5 years. K-CAB’s growth is driven by its advantages over existing proton pump inhibitor (PPI) class products, such as faster onset of action and the ability to be taken before or after meals. Daewon Pharm posted the highest growth rate among the top prescription performers due to its strong sales of cold and anti-inflammatory drugs. Daewon Pharm’s outpatient prescriptions amounted to KRW 4738 billion last year, a 15.4% year-on-year growth. Prescriptions for cold medicine Codaewon S increased 35.1% from KRW 51.9 billion in 2023 to KRW 70.1 billion last year, while prescriptions for anti-inflammatory drug Pelubi increased 30.9% year-on-year to KRW 62.2 billion last year. Daewon Pharm’s prescriptions grew 68.3% in 5 years from KRW 281.5 billion in 2019.

- Company

- 'Leclaza·Rybrevant comb therapy' wins nod in KOR

- by Son, Hyung Min Jan 14, 2025 05:56am

- YuhanThe approval of Leclaza plus Rybrevant combination therapy in South Korea has expanded treatment options for patients with non-small cell lung cancer (NSCLC). As Leclaza combination therapy has shown a positive overall survival (OS) result, it is highly likely to be the first-line standard therapy for treating EGFR-positive NSCLC. According to industry resources on January 13, the Ministry of Food and Drug Safety (MFDS) granted approval for Leclaza plus Rybrevant combination therapy as the first-line treatment for EGFR-positive NSCLC. Following the approval, Leclaza plus Rybrevant combination therapy can be used in adult patients with advanced or metastatic NSCLC who have EGFR exon 19 deletion mutation or exon 21 (L858R) point mutation. Following the approvals in the United States and Europe last year, Leclaza plus Rybrevant combination therapy was approved in South Korea as the first in Asia. The US Johnson & Johnson aims to receive approval for Leclaza plus Rybrevant combination therapy in Japan and China. The basis of approval is the MARIPOSA Phase 3 trial. The study involved 1,074 patients with locally advanced or metastatic NSCLC. The median age of patients was 63, and over half of the participants were Asian (59%). Brain metastases occurred in 41% of the participants. Patients were randomly assigned in a 2:2:1 ratio to Leclaza plus Rybrevant combination therapy, Tagrisso monotherapy, and Leclaza monotherapy. The primary endpoint was progression-free survival (PFS), a period without disease progression, and the secondary primary endpoints were overall survival (OS), PFS after the first follow-up treatment (PFS2), and an overall response rate (ORR). The clinical trial results showed the Leclaza plus Rybrevant combination therapy group had 23.7 months of PFS. The Lecalza monotherapy group had 18.5 months of PFS, which was longer than the 16.6 months of the Tagrisso monotherapy group. The Leclaza plus Rybrevant combination therapy group had 30% lower disease progression and death risk compared to the Tagrisso monotherapy group. In the MARIPOSA study, adverse reactions of over Grade 3 were reported as 75% and 43% in the Leclaza plus Rybrevant combination therapy group and the Tagrisso monotherapy group, respectively. Significant adverse reactions were reported at 49% and 33%. Treatment-related adverse reactions in the Leclaza plus Rybrevant combination therapy group mainly were Grade 1-2, such as nail infection and rash. Recently presented OS results showed that Leclaza plus Rybrevant combination therapy is superior to the Tagrisso monotherapy. Johnson & Johnson explained that Leclaza plus Rybrevant combination therapy had statistically significant extended median OS over 1 year compared to Tagrisso therapy. Since Tagrisso recorded an OS of 38.6 months in the FLAURA study, the basis of approval, the OS of Leclaza plus Rybrevant combination therapy will likely be around 50 months. The current results indicate an improvement over previous clinical data. Previously, the Leclaza plus Rybrevant combination therapy has demonstrated the efficacy regarding the primary endpoint, PFS. The secondary endpoint, OS, had shown a favorable trend compared to Tagrisso. If the efficacy of Leclaza plus Rybrevant combination therapy is confirmed in OS, in addition to PFS, then it will become the next standard therapy for EGFR-positive NSCLC.

- Company

- Samsung Bioepis partners with Teva for Soliris biosimilar

- by Cha, Jihyun Jan 14, 2025 05:56am

- Pic of Samsung Bioepis Headquarters Samsung Bioepis announced on the 12th that it has signed a commercialization partnership agreement with the multinational pharmaceutical company Teva Pharmaceutical Industries to launch Epysqli, a biosimilar of the rare disease treatment Soliris (eculizumab), in the U.S. market. Epysqli is the first hematology biosimilar developed by Samsung Bioepis. Its original drug, Soliris was developed by Alexion, a U.S. company specializing in rare disease treatments. It is used for rare intractable diseases such as paroxysmal nocturnal hemoglobinuria (PNH) and atypical hemolytic uremic syndrome (aHUS). It is an ultra-high-priced drug that posted global sales of approximately KRW 5 trillion in 2023. Samsung Bioepis obtained the U.S. Food and Drug Administration (FDA) approval for Epysqli for PNH and aHUS in July last year. In November last year, the company expanded the indication to include generalized myasthenia gravis (gM) through additional FDA approval. Under the agreement, Samsung Bioepis will launch Epysqli in the U.S. market through Teva, and the release is expected in the first half of this year. Samsung Bioepis will be responsible for the production and supply of Epysqli. Teva will be responsible for marketing and sales activities in the U.S. “Epysqli is a drug that best realizes the essence of biosimilar development as it enables expanded access to ultra-high-priced biologics,” said Kyung-Ah Kim, CEO of Samsung Bioepis. “We look forward to working closely with Teva to improve the lives of patients with rare diseases in the U.S.” “We are pleased to partner with Samsung Bioepis to help expand patient access,” said Chris Fox, Executive Vice President US Commercial at Teva Pharmaceuticals. ”We look forward to leveraging our commercial capabilities with Samsung Bioepis to expand treatment access for our patients.”

- Company

- Will biotech companies continue 'K-Bio' success?

- by Moon, sung-ho Jan 13, 2025 05:53am

- Korean pharmaceutical and biotech companies have successfully outlicensed new drugs in various fields, including cancer, autoimmune disease, and Alzheimer's disease. However, compared to the year before, analysis suggests that the number of out-licensed cases decreased. Despite such a slowdown, companies focusing on global new drug development trends, including Alzheimer's disease treatment and antibody-drug conjugates (ADC), have drawn interest from the industry following achieving grand-size contracts. We analyzed major out-licensing cases from Korean pharmaceutical and biotech companies in 2024 and explored the potential of future out-licensing possibilities for 2025. According to pharmaceutical and biotech companies on December 30, 2024, the number of out-licensing transactions in the Korean pharmaceutical and biotech industry for 2024 was 14. Compared to last year's 18 cases, it is a slight decrease. However, analyzing out-licensed transactions, companies that have achieved this by focusing on global new drug development trends stand out. First, LigaChem Biosciences and Orum Therapeutics have successfully out-licensed for two consecutive years, and becoming blu-chip companies in the pharmaceutical and biotech industry. In October 2024, LigaChem Biosciences and a Japanese pharmaceutical company, Ono-Pharma, signed two technology transfer agreements, including the L1CAM-targeting ADC candidate 'LCB97.' According to the contract between both companies, the specific upfront payment remains undisclosed. Two agreements total over US$700 million (KRW 943.5 billion). L1CAM, targeted by LCB97, is a protein expressed in several solid cancers, including lung cancer, pancreatic cancer, and colorectal cancer. LigaChem Biosciences' proprietary ConjuAll linker was used in the development of LCB97. ADC is made of a linker, a payload, and an antibody. The ConjuAll linker is known to overcome the issue of releasing cytotoxic drugs into the blood and attacking healthy cells. In addition to the LCB97 deal, LigaChem Biosciences and Ono-Pharma signed an agreement to transfer the ADC platform technology designed to target dual targets. Based on the contract, using LigaChem Biosciences' platform technology, Ono-Pharma secured rights to discover·develop ADC candidates for multiple targets. Orum Therapeutics has proven its R&D capacity by successfully out-licensing the DAC platform to global pharmaceutical companies. In July last year, the company signed an out-licensing agreement with the U.S.-based biotechnology company Vertex Pharmaceuticals for its DAC. Orum Therapeutics received a US$15 million upfront payment and will receive up to $310 million in potential option fees, milestone payments per target, and tiered royalties. Notably, the company has succeeded in advancing the development of new drugs for cancer, autoimmune diseases, and Alzheimer's disease. HK inno. N signed a license agreement with Navigator Medicines, a US-based pharmaceutical company, for 'IMB-101,' a novel drug candidate for the treatment of autoimmune diseases. The contract totaled US$940 million (approximately KRW 1.3 trillion), including an up-front payment of US$20 million (KRW 27.6 billion). Navigator Medicines secured global development and sales rights through this agreement, excluding Asia. AprilBio also successfully out-licensed 'APB-R3,' an autoimmune disease candidate, to a US-based new drug developer, Evommune. It has been contracted for up to US$475 million (approximately KRW 655 billion), including a non-refundable upfront fee of US$15 million (KRW 20.7 billion), with a separate royalty payment for sales. Aribio successfully out-licensed 'AR1001,' a new drug candidate for Alzheimer's disease, to a Chinese pharmaceutical company in March 2024. Aribio received an upfront payment of KRW120 billion. The company made an advancement in developing an oral new drug candidate for Alzheimer's disease amid increased interest in Alzheimer's disease treatment following the release of Leqembi (lecanemab). AR1001 targets the underlying causes of Alzheimer’s disease through multimodal mechanisms, such as PDE5 and toxic proteins. This new drug candidate is based on Mvix (mirodenafil), which is similar to Viagra and a treatment for erectile dysfunction. Jai Jun Choung, CEO of Aribio, said, "The global market is closely watching Aribio's AR1001." Choung added, "Since Aribio is the first Korean biotech company to conduct a global phase 3 trial in the field, we are striving to achieve success." Particularly this year, Korean companies have not been limiting their goals in exporting new drug candidates. For instance, 'Alteogen' has achieved multiple successes in out-licensing its technology to change the type of anticancer agent formulation. In November 2024, Alteogen signed an exclusive license agreement with Daiichi Sankyo to develop and sell the new ADC drug 'Enhertu' of a subcutaneous (SC) formulation. The company received a non-refundable upfront payment of US$20 million. Enhertu, an antibody-drug conjugate (ADC) jointly developed by Daiichi Sankyo and AstraZeneca, has been approved for the treatment of HER2-positive breast cancer and gastric cancer. As Enhertu demonstrated to be effective in HER2 mutant NSCLC and HER2-low breast cancer, its indication was expanded. Soon Jae Park, CEO of Alteogen, said, "We will be able to provide an alternative administration route by developing a subcutaneous formulation of Enhertu by signing a partnership with Daiichi Sankyo and using ALT-B4," Park added, "We hope to provide a wide variety of treatment options to patients by utilizing ALT-B4 to numerous treatments in the future." Global pharmaceutical companies with major immunotherapy strive to change conventional injectables to subcutaneous formulations. In this process, Alteogen is co-developing the SC formulation of Keytruda with MSD. It has been reported that Alteogen achieved growth through pursuing the Enhertu formulation change project. Conventional anti-cancer treatments are primarily intravenous (IV) therapy, and the administration takes more than one hour. Anti-cancer treatments of SC formulation are expected to improve patient convenience since they can significantly reduce the administration duration to within 10 minutes. Professor Byoung Chul Cho (Director of the Lung Cancer Center at Yonsei Cancer Hospital) said, "The United States provides incentives to using injections, and the amount of incentives is the same between IV injectable or SC injectable," and explained, "There is no need to maintain IV formulation injectables, which commonly induce injection-associated adverse reactions." With these advancements, companies adopting differentiated strategies in global new drug development trends are likely achieve additional out-licensing cases by 2025. Analysis suggests that the global pharmaceutical industry will likely continue pursuing pipelines in various fields, such as autoimmune diseases, radiopharmaceuticals, cell therapies, and Alzheimer's treatments. If companies, like the case of Alteogen, also pursue a differentiation strategy as an advantage, they are expected to maintain strong competitiveness. Major global pharmaceutical companies, including Vertex Pharmaceuticals, Gilead Sciences, AbbVie, Lilly, Merck, and Sanofi, have actively expanded their pipelines through M&A this year. The largest M&A deal of the year was Vertex Pharmaceuticals's acquisition of Alpine Immune Sciences. A contract worth US$4.9 billion (approximately KRW 7.03 trillion), including milestone achievements, has been signed. Based on the agreement between the two US-based global pharmaceutical companies, Vertex has secured povetacicept. Povetacicept is a bispecific antibody targeting APRIL, which is involved in the proliferation of BAFF for B-cell activation. Vertex also signed an out-licensing agreement with the Korean biotech company Orum Therapeutics. Analysis suggests a high likelihood that global pharmaceutical companies will continue efforts to secure future growth opportunities as patents for their therapies expire, suggesting that Korean pharmaceutical and biotech companies have significant potential for out-licensing. However, investor sentiment has declined in the pharmaceutical and biotech industry this year, posing risks to clinical research efforts and potentially hindering technology export achievements next year. Seung-Kyou Lee, Vice President of the Korea Biotechnology Industry Organization (Korea Bio), said, "In response to the urgent issue of decreased investment in the biotech sector, we strive to actively facilitate domestic and international investor matching and operate a demand-supply company committee." Lee added, "We need measures to identify and support solutions for the business and policy demands of biotech companies working in various fields."

- Company

- Samsung Bioepis to indirectly sell Soliris biosimilar in US

- by Cha, Jihyun Jan 13, 2025 05:53am

- Samsung Bioepis has signed a partnership agreement with the multinational pharmaceutical company Teva Pharmaceuticals to commercialize biosimilars of rare disease treatments in the United States. Samsung Bioepis will launch the biosimilar through Teva in the U.S. market in the first half of this year. Unlike in Europe, where Samsung Bioepis has been selling its drug directly, the company's strategy in the U.S. has been to forge a partnership to enter the market. Analysts say this is due to the complex structure of the U.S. drug market, which is centered on private insurance, and the cost burden of direct sales. Samsung Bioepis enters into a partnership with Teva to commercialize Epysqli... to launch in the U.S. in the first half of the year Samsung Bioepis According to industry sources on the 13th, Samsung Bioepis recently signed a commercialization partnership agreement with Teva to launch Epysqli, a biosimilar version of the rare disease treatment Soliris (eculizumab), in the US market. Soliris was developed by Alexion, a U.S. developer specializing in rare disease therapies. It received marketing authorization from the U.S. Food and Drug Administration (FDA) in March 2007 and the European Commission (EC) in June of the same year. In 2021, AstraZeneca acquired Alexion and took over the rights to Soliris. Soliris is indicated for rare diseases, including paroxysmal nocturnal hemoglobinuria (PNH), atypical hemolytic uremic syndrome (aHUS), neuromyelitis optica syndrome disorder (NMOSD) generalized myasthenia gravis (gMG). In 2023, Soliris reported global sales of USD 3.145 billion (approximately KRW 4 trillion). Of this, the U.S. market is estimated to be worth about KRW 2.3 trillion and the European market is estimated to be worth about KRW 1 trillion. Epysqli is the first hematology biosimilar developed by Samsung Bioepis. Samsung Bioepis obtained the EC marketing authorization for Epysqli for PNH in May 2023 and launched it in the European market in July of the same year. In Korea, it has been on the market since January last year after receiving approval from the Ministry of Food and Drug Safety. In the U.S., the FDA approved Epysqli for PNH and aHUS in July last year. In November last year, the FDA approved an additional indication for its treatment of gMG. Under the agreement, Samsung Bioepis will launch Epysqli in the U.S. market through Teva. The launch is expected in the first half of this year. Samsung Bioepis will be responsible for the production and supply of Epysqli. Teva will be responsible for the drug’s marketing and sales activities in the US. This agreement brings Samsung Bioepis' total number of international partners to four. Samsung Bioepis currently has forged commercialization partnerships with Biogen, Organon, and Sandoz in overseas markets. The partners have exclusive rights to sell the contracted products in the targeted territories and pay Samsung Bioepis milestones and sales commission royalties. Under the new agreement, Samsung Bioepis will receive milestone payments from Teva. Both companies will also share a percentage of product sales revenue. Specific milestone amounts and revenue-sharing percentages for each company were not disclosed. Decided to forge partnership in the U.S., unlike selecting direct sales in Europe, considering the U.S drug structure and costs Epysqli is the only product that contains the company’s name in the product name and is also Samsung Bioepis’ first direct sales product. Epysqli indications, PNH, and aHUS are among those ultra-rare diseases that have a very small number of patients. Samsung Bioepis decided to establish a direct sales system for the first time for Epysqli among all its products, believing that it could fully carry out sales activities with its small number of salespeople. By selling directly without distributing through partners, Samsung Bioepis can reduce commission expenses and increase profitability. Domestic companies pay around 30% to 40% of sales on average as commission to partners when expanding overseas. Another advantage is that it gives the company more market control. In Europe, the effects of the company’s direct sales are slowly showing results. As of the third quarter of last year, Epysqli held the No. 1 market share for eculizumab-based biosimilars in Germany and Italy. It has also secured contracts with the largest procurement group in France (UniHA) and the Dutch government. Samsung Bioepis Nevertheless, Samsung Bioepis' decision not to directly market Epysqli in the U.S. was based on the complex drug structure in the U.S. and the initial direct marketing costs. The European drug market uses a tender system, making it relatively easy to enter. On the other hand, the U.S. drug market has a complex structure centered on private insurance, so it would have been difficult for the company to go direct. The cost of establishing an initial direct sales system may also have been a burden. While the profitability of a direct sales system increases with the number of products sold, it requires large fixed costs to establish a local subsidiary and hire specialized sales and marketing personnel. Will seek to accelerate its entry into the U.S. market with its lower drug price than the original (KRW 400 million/year) and product competitiveness Samsung Bioepis aims to speed up its expansion into the U.S. market by capitalizing on Epysqli’s price competitiveness and product competitiveness. Soliris is an ultra-high-priced drug that costs about KRW 400 million per year. Epysqli’s domestic drug price is set at KRW 2.51 million per vial. This is half the price of the original drug, which costs KRW 5.13 million. This is also about 30% lower than the price of Soliris, which was newly introduced in April last year at KRW 3.6 million. The idea is to gain an advantage over the original through its price competitiveness and expand patient access. Being ‘sorbitol-free' is also considered a competitive advantage of Epysqli. Sorbitol is a substance that helps improve the stability of medicines. However, it can cause reactions in patients with fructose intolerance, who cannot digest fructose precursors such as fructose or sugar. In Europe, medications containing sorbitol are banned for people with fructose intolerance. The U.S. has no such prohibition. However, industry experts believe that given the potential for reactions in some patient populations, it is likely that clinicians will favor products without sorbitol. Epysqli’s competitor, Amgen's Soliris biosimilar Bkemv contains sorbitol. However, the original company’s patent defense strategy may serve as a variable. Alexion is marketing Ultomiris, a once-eight-weekly dosing version of Soliris that offers improved dosing convenience. Both Soliris and its biosimilar are administered intravenously every 2 weeks. In this regard, Samsung Bioepis believes that there is enough market potential as there is still a demand for Soliris in the medical field and there are many markets where Ultomiris has not entered yet. “Teva is a generic and biosimilar company with extensive sales and marketing infrastructure in the U.S. market,” said a Samsung Bioepis official. ”We chose Teva as our commercialization partner for Epysqli in the U.S. market because of its experience and expertise in the U.S. market.” The official added, “The market for Soliris is much larger in the U.S. than in Europe, and we are excited to see how Epysqli will sell in the U.S. given its success in Europe.”

- Company

- Wegovy can be prescribed in tertiary hospitals in KOR

- by Eo, Yun-Ho Jan 13, 2025 05:53am

- The obesity drug ‘Wegovy’ can now be prescribed in tertiary hospitals in Korea. According to industry sources, Novo Nordisk Korea's Wegovy (semaglutide) has passed the drug committees (DCs) of Korrea’s “Big 5 medical institutions,” including Samsung Medical Center, Seoul National University Hospital, and Sinchon Severance Hospital. Wegovy was approved by the U.S. Food and Drug Administration (FDA) in June 2021 and was granted marketing authorization in Korea in October last year. The once-weekly obesity treatment is approved as an adjunct to a reduced-calorie diet and increased physical activity for weight management, including weight loss and weight maintenance, in adult patients. Specifically, it is indicated for use in obese patients with an initial body mass index (BMI) of 30 kg/m2 or greater or in overweight patients with one or more weight-related comorbidities and a BMI of 27 kg/m2 or greater but less than 30 kg/m2. Obesity is associated with chronic diseases such as hypertension and type 2 diabetes and is known to contribute to the development of cardiovascular disease and cancer. The number of obese people in Korea is steadily increasing, with the obesity rate in Korea reaching 37.1% in 2021. The starting dose of Wegovy is 0.25 mg once a week and is gradually increased to a maintenance dose of 2.4 mg once a week for 16 weeks. Wegovy is available in five dosage forms: 0.25 mg, 0.5 mg, 1.0 mg, 1.7 mg, and 2.4 mg. The efficacy and safety profile of Wegovy was demonstrated through the large-scale STEP trial. In the multinational trial that involved 1,961 adult overweight or obese patients, the Wegovy-treated group demonstrated a mean weight loss of 14.9% from baseline over 68 weeks (1,306 patients) compared to 2.4% in the placebo group (655 patients), demonstrating a significant difference. All overweight or obese patients in the trial were on a reduced-calorie diet and increased physical activity.

- Company

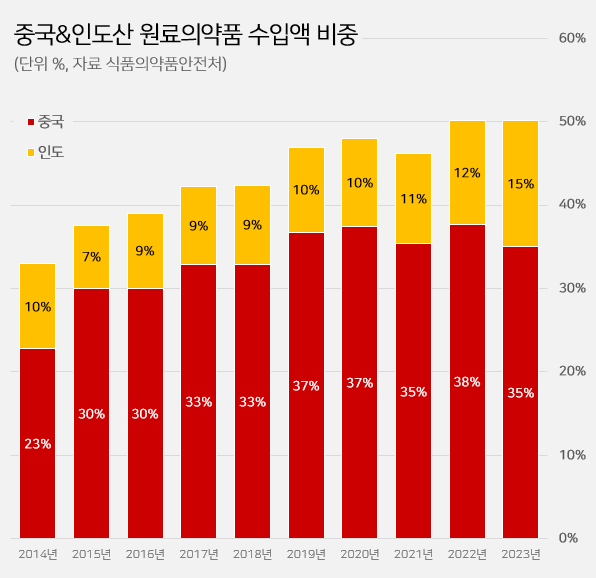

- Imported API from China·India reaches 50%

- by Kim, Jin-Gu Jan 13, 2025 05:53am

- It has been reported that half of the active ingredients (API) imported to South Korea are produced in China and India. The percentage of imported active ingredients originating from China·India surpassed 50% in two consecutive years. The percentage of imported API from India has robustly increased recently. Indian API imports were below 10% in 2018, now expanded to 15.2% in five years. In contrast, the percentage of Chinese API imports slightly dropped from 36.7% to 35.0%. According to the 'Annual report of food and drug statistics for 2024' by the Ministry of Food and Drug Safety (MFDS) on January 11, domestically imported API in 2023 totaled US$ 2.199 billion. Among these, API imports from China·India totaled US$ 1.1 billion. Imports from China·India account for nearly 50.2% of the total imported API. It indicates that half of domestically imported API is from China·India. Analysis suggests that reliance on API produced in China·India has consistently increased. The percentage of imported API from China·India surpassed 40% in 2017, rising to over 50% by 2022. It recorded over 50% in two consecutive years until 2023. The percentage of imported API from China·India: API imports from China and India surpassed 40% in 2017, rising to over 50% by 2022. It recorded over 50% in two consecutive years until 2023. (unit: %, source: Ministry of Food and Drug Saftey). API imports from China have declined, while imports from India have risen. Imported API from China in 2023 totaled US$ 769.76 million, a drop of 16.0% from US$ 916.87 million in 2022. Imported API from India rose by 10.1% from US$ 303.30 million in 2022 to US$ 334.00 million in 2023. Looking into the years before, imported API from India has shown an increasing trend for the past few years. In 2018, imported API from India was US$ 195.56 million, an increase of 70.8% in five years. The percentage of imported API from India was merely 9.5% in 2018, while it rose by 5.7% in five years to 15.2% in 2023. Analysis suggests that as the decrease in imports from China has been compensated by API from India, South Korea has increasingly depended on APIs produced from both countries. As of 2023, besides China·India, there are no imported API from other countries that account for more than 10%. Japan ranks third in the amount of imported API in 2023, totaling US$ 198.85 million (9.0%). Japan's share had sustained over 10% until 2022. Followed by France US$ 170.66 million (7.8%), Italy US$ 123.59 million (5.6%), Germany US$ 120.81 million (5.5%), the U.S. US$ 66.14 million (3.0%), Spain US$ 44.67 million (2.0%), Switzerland US$ 36.77 million (1.7%), and Belgium US$ 31.78 million (1.4%).